Debt Capital Market Update – Q1 2019

TKO Miller Debt Capital Market Analysis

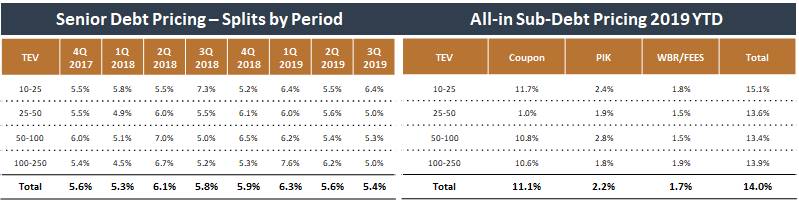

- Leverage multiples remain at peak levels in M&A transactions due to an aggressive lending environment

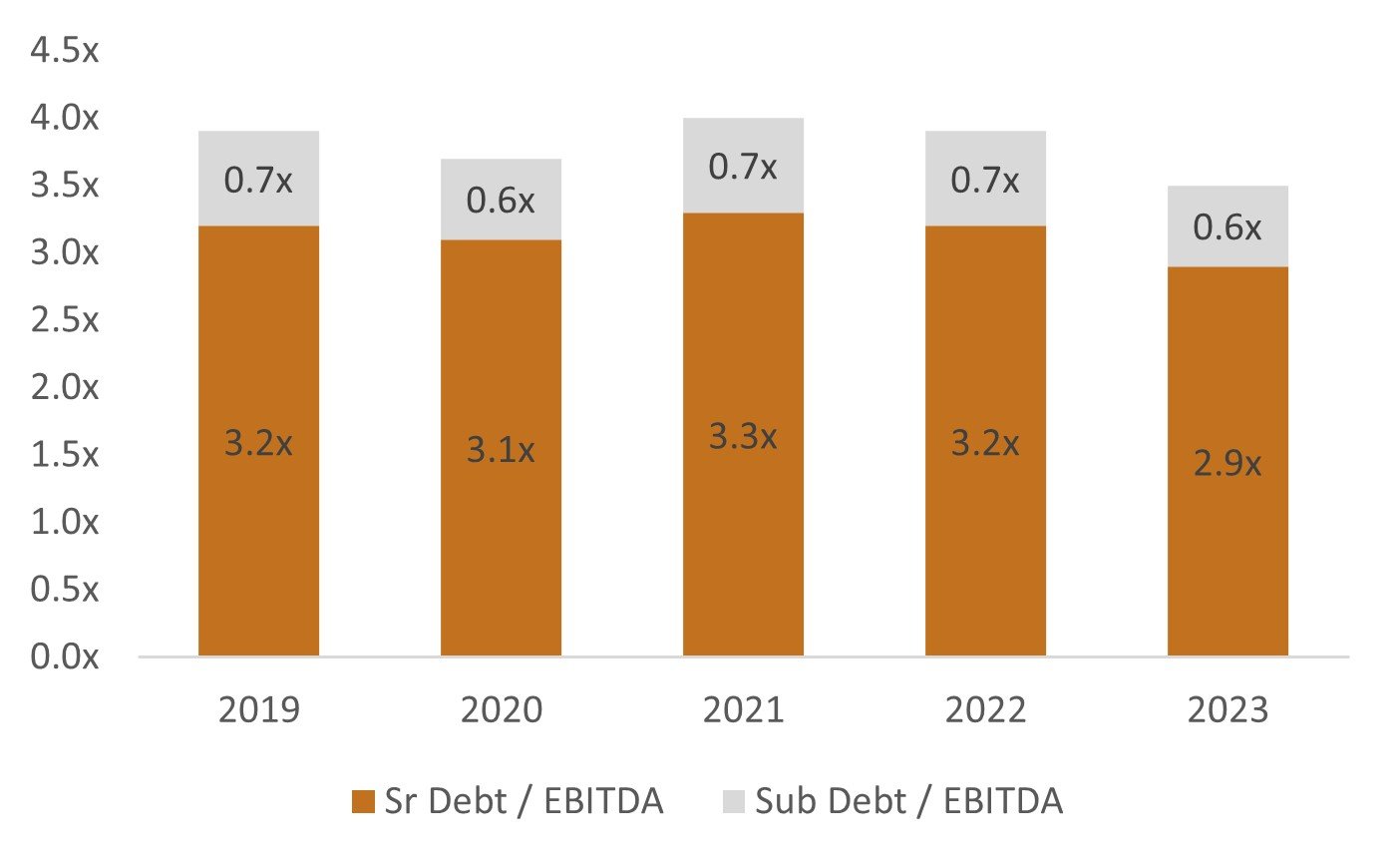

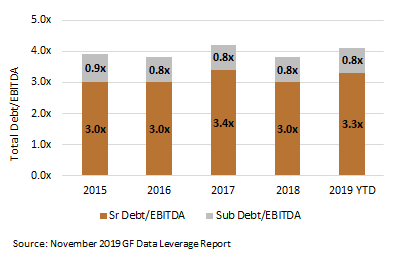

- Leverage multiples, as measured by Total Debt/EBITDA increased from 3.5x in 2012 to 3.9x in 2018 (as depicted in the graph below)

- The low cost of debt will fuel aggressive growth initiatives for both strategic and financial buyers (i.e. greater ability to fund acquisitions)

- The debt market is a key underlying driver of M&A valuations; valuations will decrease when leverage multiples fall and the cost of debt increases

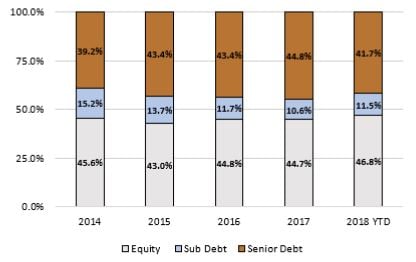

- Transactions will see increasing equity contributions in response to lower debt multiples and rising purchase price multiples compared to 2017 levels (as depicted in the graph below)

- TKO Miller projects leverage conditions to remain highly supportive over the coming 9-15 months, but trade tariffs with China, a global economic downturn, or uncertain political conditions are capable of shifting conditions back to historical levels

Total Debt/EBITDA Multiples

Debt and Equity Contribution by Year

TKO Miller Recent Debt Financing Transaction

TKO Miller Served as the Exclusive Debt Advisor for Oneida Airport Hotel Corporation

TKO Miller advised Oneida Airport Hotel Corporation (OAHC) on the successful closing of a new commercial loan package. Known as an industry leader, OAHC owns several hotels in the Green Bay, Wisconsin area, consisting of approximately 500 rooms. After finding limited success in trying to obtain new financing on its own, OAHC realized that this project’s size and scope required experienced professional assistance and turned to TKO Miller.

“OAHC found that it was no longer meeting its existing bank’s definition of a target customer,” said Steve Yahnke, Managing Director, TKO Miller. “Navigating the complex and fragmented commercial lending world and obtaining long-term, fixed-rate financing post 2008 has become more difficult.”

TKO Miller quickly determined that OAHC’s loan request was highly serviceable and that OAHC would be an attractive “relationship client” for many financial institutions. After structuring the required financing to include a revolving line of credit and two mortgage loans, TKO Miller identified the most appropriate senior lenders for OAHC, including regional and national commercial banks, along with numerous other real estate lenders, such as pension funds, insurance companies, and bond issuers. TKO Miller conducted a targeted and efficient process that allowed OAHC to achieve its objectives. The winning proposal, a syndicated group of regional banks, provided OAHC with the flexibility and the availability it needed to fund its future growth initiatives.

“TKO Miller procured multiple, competitive proposals for the transaction,” said Bob Barton, OAHC Board President. “In the end, we were very impressed with the final financing structure and the attractive economics of the deal.”

Interest Rate Update

- In the fourth quarter of 2018, the 3-month LIBOR rate increased to 2.8% following the Fed’s raising of the federal funds target rate by 25 basis points for the ninth time since 2015

- The most recent yield curve has less than a 50 basis point spread between the 1-month US Treasury and a 30-year Treasury, suggesting that this flattening of the yield curve could mean an economic slowdown is on the horizon (as depicted in the graph below)

- Recent FOMC guidance suggests that the original forecast of two to three rate hikes in 2019 may be delayed until 2020, an election year

- The annual inflation rate slowed for the third straight month to 1.6% in January 2019 from 1.9% in December 2018, primarily due to a sharp decline in gas prices

- Banks and other lenders are eager to place capital, however they are quick to pull-back, which could prohibit businesses and consumers the necessary access to capital, which could slow future economic growth

- Now may be a good time to lock in fixed interest rates over a 10-year period or more (10-year treasury at roughly 2.6%, as depicted in the graph below). Commercial banks may be able to lock in a rate as long as 10 years with an Interest Rate SWAP (floating-to-fixed and could be around 5.25% to 5.5%) and up to 20 to 25 years using the SBA 504 program (both currently sub-5.0%)

- Other non-bank lenders such as Insurance Companies (approximately 4.5%) or Pension Funds (averaging 5.0%) may be able to lock in longer-term rates (15 to 20 years) for the purchase of fixed assets, dividend recapitalizations, shareholder buyouts and/or acquisition financing

Daily Treasury Yield Curve Rates

10-Year Treasury Rate

About TKO Miller

TKO Miller, LLC is an independent, advisory-focused, middle market investment bank. With over 130 years of collective transaction experience, TKO Miller provides merger and acquisition and financial advisory services for privately-held and private-equity owned businesses, with a special focus on family-and-founder-held businesses.

TKO Miller aims to bring value to clients by combining outstanding people with a results-oriented, flexible approach to transactions. Our services include company sales, recapitalizations, asset divestitures, and management buyouts. TKO Miller has a generalist focus and has served clients in a wide range of industries, including manufacturing, business services, consumer products, and industrial products and services. For more information, visit our website www.tkomiller.com