Flexible Packaging Newsletter – Q1 2022

Flexible Packaging Trends

Q1-2022 M&A activity has sustained its trajectory from 2021; we saw both strategic and financial buyers continue their pursuit of transactions across several industries. Despite a strong start to the year, the momentum is starting to face some challenges, many created by uncertainty in the global economy.

- Inflation is becoming a growing concern for flexible packaging manufactures. Increases in energy, transportation, and labor costs, have led to a tight market with high operating costs. In addition, the conflict between Russia and Ukraine, Russian sanctions, and the geopolitical repositioning among western and eastern countries, is influencing additional price increases of raw materials.

- The tight U.S. labor market continues to cause employers significant headaches. Wage increases alone have not been enough to entice and recruit skilled workers.

Despite these challenges affecting the flexible packaging industry, there are very favorable M&A conditions for flexible packing owners.

- Financial buyers have a large amount of excess capital (dry-powder) that they need to deploy. For financial buyers, flexible packaging is considered a desirable industry due to its healthy growth, low volatility, and attractive long-term economics, while delivering an essential solution/product to the overall economy. Also, the industry is fragmented, which suggests ample opportunities for consolidation and achieving economies of scale.

- Strategic buyers are actively seeking transactions to expand their capabilities, customers, market power, and to create centers of excellence.

We don’t believe the packaging industry will be isolated from the storms brewing in the global economy and will continue to face the same labor and supply chain challenges as most U.S. manufacturers. However, we believe that the industry will continue to be an active market for M&A transactions for at least the next two quarters.

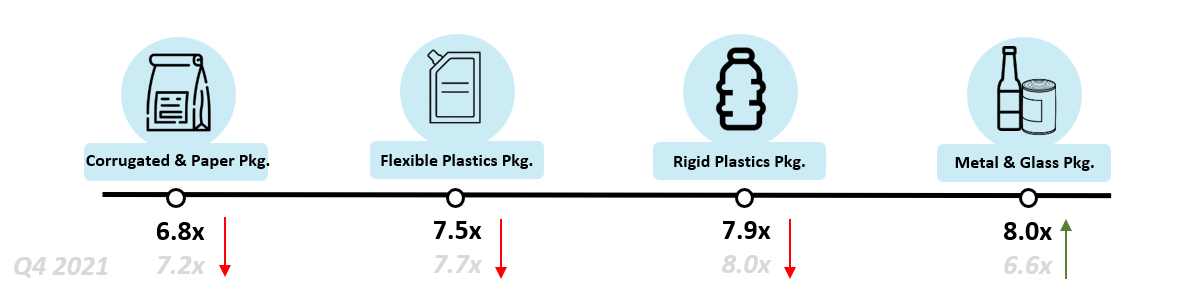

Where Are Packaging Subsectors Valued? (EV/EBITDA)

Source: TKO Miller’s Proprietary Middle Market Flexible Packaging Index

Recent Flexible Packaging News

Russia’s Invasion of Ukraine and its Impact on the Plastics Industry

Russia’s invasion of Ukraine and the economic sanctions imposed on Russia have disrupted the oil market, something most noticeable at the gas station. But crude oil isn’t only refined into gasoline. Refineries turn fossil fuels into petrochemicals which, in turn, become plastic. The crude oil price has hit plastic producers’ margins, and some are starting to curb production. Petroleum is at the root of so many different products, from makeup to plastic bags to fertilizer. These higher oil prices will most likely lead to more expensive food and consumer products. [LINK]

The Flexible Packaging Market Continues its Aggressive Growth Trajectory

According to Research & Market’s newly issued market report, the global flexible packaging market size reached $124.9 Billion in 2021. Looking forward, the publisher expects the market to reach $162.4 Billion by 2027, exhibiting a CAGR of 4.5% during 2022-2027. Hot pockets of the industry include food packaging and medical packaging, which are projected to grow from $19.3 Billion in 2020 to $24.4 Billion by 2026. [LINK]

Rising Demand for Flexible Packaging Films

The global packaging films market is expected to reach a market size of $164.11 billion by 2028. Rapid growth of packaging films can be attributed to the rising demand for flexible packaging as food and beverage product manufacturers are increasingly adopting flexible films based on polyethylene due to its distinct barrier properties that help with better protection or longer shelf life. [LINK]

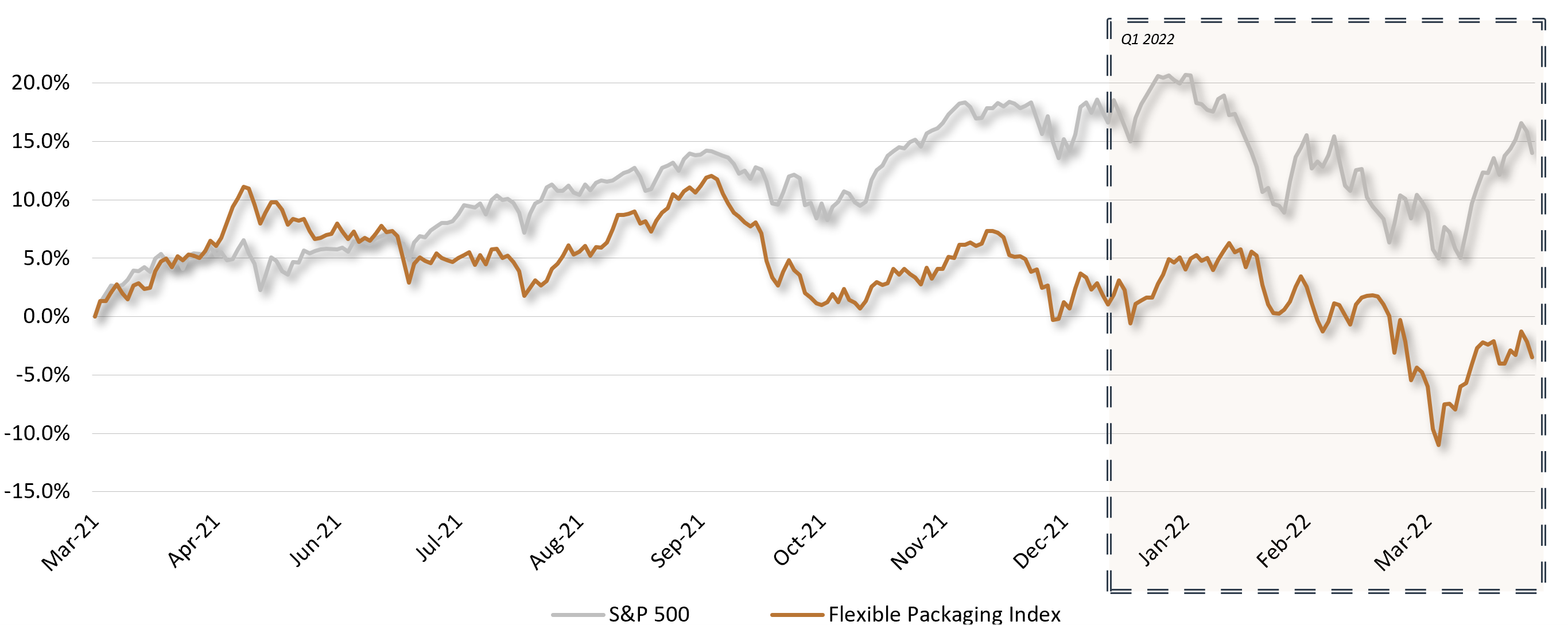

Flexible Packaging Market Performance vs S&P 500

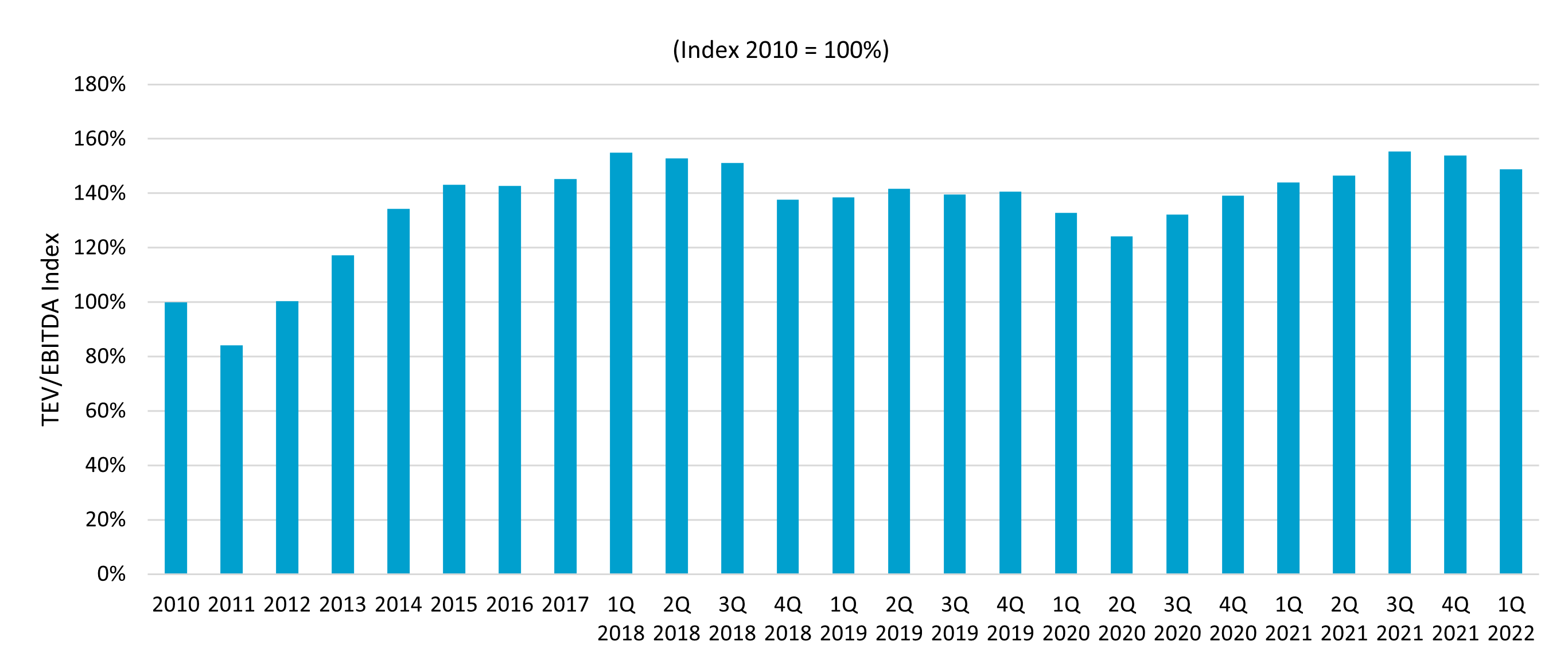

Flexible Packaging Valuation Index

Source: TKO Miller’s Proprietary Flexible Packaging Valuation Index

Recent Flexible Packaging Transactions

January 2022 – Vonco Products, Inc. Acqures Flex-Pak Packaging Products, Inc.

Vonco Products, a contract manufacturer of medical devices and fluid bags and clean room assembly, packaging, sterilization management, and distribution, has acquired Flex-Pak Packaging Products, a manufacturer of customized plastic bags and pouches for the healthcare industry. The acquisition provides Vonco Products’ customers with additional expertise and greater value in terms of support and service.

February 2022 – The Fedrigoni Group Acquires Spanish Company, Divipa

The Fedrigoni Group, a leader in the production of high value-added special papers for packaging, publishing, and graphics, as well as premium labels and self-adhesive materials, has acquired Divipa, a developer, manufacturer, and distributer of self-adhesive materials. The acquisition further strengthens the Fedrigoni Group’s position as the third player in the world for self-adhesive materials and enables the company to obtain a direct stronghold in all the main geographical markets.

February 2022 – AWT Labels & Packaging Acquires Labeltronix

AWT Labels & Packaging, a leading provider of custom packaging, labeling, and converting solutions, has acquired acquisition of Labeltronix, one of the leading manufacturers of premium craft labels with headquarters in Anaheim, CA. The acquisition will add to AWT’s end-market presence of high-end premium crafted label manufacturing capabilities and will have an immediate impact in adding value for existing and new customers.

March 2022 – C-P Flexible Packaging, Inc. Acquires Bass Flexible Packing, Inc.

C-P Flexible Packaging, Inc. a manufacturer of custom flexible packaging and printing solutions for various applications and markets, has acquired Bass Flexible Packaging, Inc., a manufacturer of custom shrink bands and custom retail packaging headquartered in Lakeville, MN.

About TKO Miller

TKO Miller, LLC is an independent, advisory-focused, middle-market investment bank. With over 130 years of collective transaction experience, TKO Miller provides merger and acquisition and financial advisory services for privately-held and private-equity-owned businesses, with a special focus on family-and-founder-held businesses.

Flexible Packaging is one of TKO Miller’s core industry focuses, along with Consumer Products, Industrial Services, Manufacturing, Business Services, and Healthcare. After advising numerous flexible packaging and printing companies on M&A and financing transactions, TKO Miller’s professionals have developed deep industry knowledge and a broad contact network that accompanies their transaction expertise with privately-held companies.

TKO Miller aims to bring value to clients by combining outstanding people with a results-oriented, flexible approach to transactions. Our services include company sales, recapitalizations, asset divestitures, and management buyouts. TKO Miller has a generalist focus and has served clients in a wide range of industries, including manufacturing, business services, consumer products, and industrial products and services. For more information, visit our website www.tkomiller.com