Industrial and Construction Services Newsletter – Q2 2023

TKO Miller Market Analysis

Industrial and Construction Services

- Most construction and industrial service business owners in North America continue to report strong performance through Q2, but there are signs that things are beginning to slow

- Commercial construction activity remain high throughout the U.S. but new projects in early stages are declining, driven by a combination of high interest rates and uncertainty in the commercial real estate market

- Many commercial construction businesses expect 2023 to finish strong but are less optimistic for 2024 and beyond

- Conversely, industrial maintenance and construction activity is performing well, and specialty industrial contractors report growing backlog and a positive outlook for the next 12-18 months

M&A Conditions

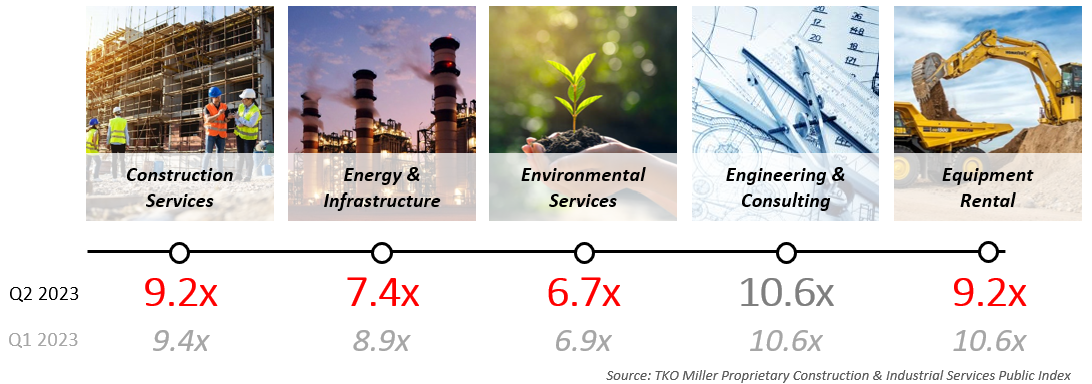

- All industrial subsectors in the TKO Miller Index declined in Q2 – with the exception of engineering & consulting – which remained flat

- The number of construction and industrial service transactions in the market has slowed, with large strategic buyers less active and fewer large, marquee deals compared to 2022

- Strategic buyers are being selective in the opportunities they pursue aggressively, and are spending time on organic growth/operational improvement initiatives in the absence of transactions

- Private equity buyers remain very aggressive across many industry sub-sectors and industrial/municipal services remains a key focus area

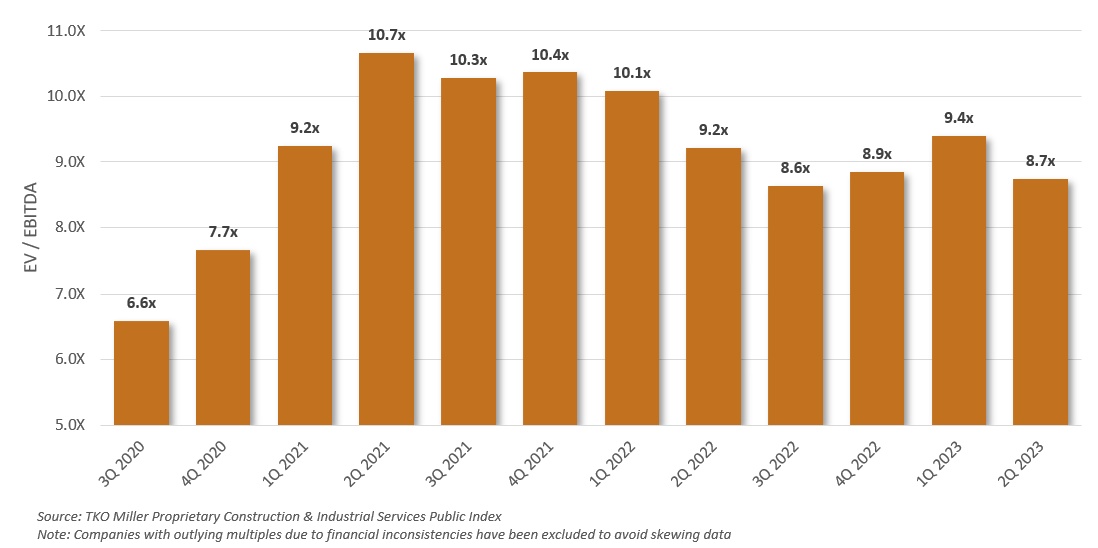

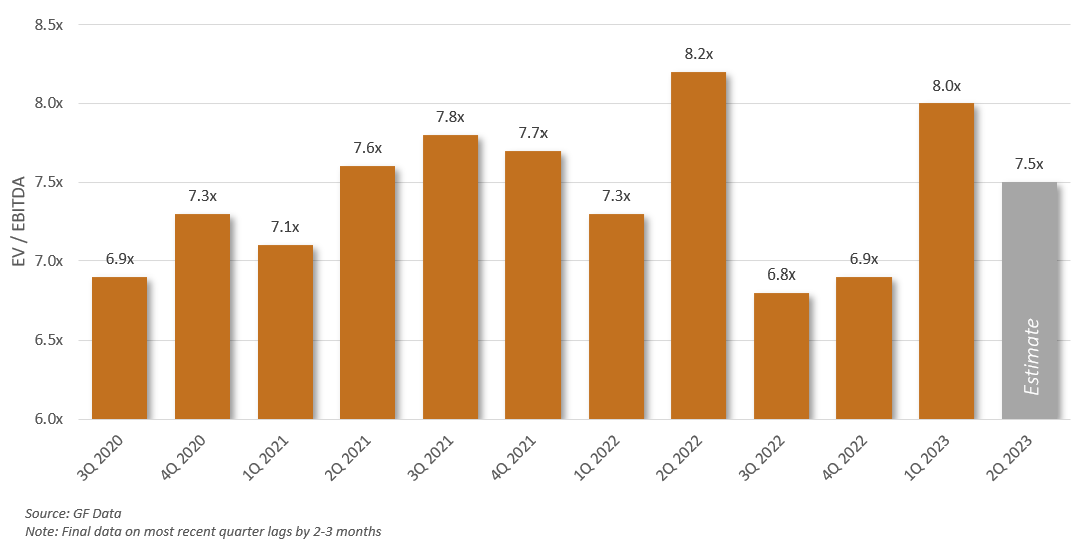

- That said, valuations are trending down slightly for construction and industrial service assets (see chart below)

Jim Rogers’ Industry Spotlight

- June YTD commercial and multi-family new construction declined $21B (-14%) in 2023 compared to the

first half of 2022. NYC saw the largest decline of $5B (-31%)

first half of 2022. NYC saw the largest decline of $5B (-31%) - Commercial and multi-family could see an even greater drop off in the second half of 2023 as higher interest rates continue to add pressure

- Breaking ground on the $2.6B JFK Terminal 6 could relieve some of the pressure in the NYC metro region

- Industrial construction continues to be robust and should carryover for quite a while. In July, Bechtel was awarded a $12B LNG construction contract in Brownsville, TX. This comes on the heels of being awarded a $13B LNG construction contract in Port Arthur, TX in March

- Spending on infrastructure continues to ramp up in all categories. In aggregate, construction is up 11% in 2023 for infrastructure and we have yet to see the full impact of the incentives rolled out by the Federal Government. There should be strong tailwinds in this category

- Total construction put-in-place spending peaked in 2022 and is forecasted to decline through 2025. Although this sounds bleak, it is worth noting the projected spending in 2025 will still be higher than pre-pandemic levels. Softening, but still robust

- The $2.3B Sphere in Las Vegas is complete, but this is not the final large project of the year in Las Vegas. Formula 1 inaugurates their premier Las Vegas Grand Prix race in November after an investment of $500M in permanent and temporary facilities, barriers and road improvements. The course encircles three sides of the Sphere

Where Are Industrial & Construction Subsectors Valued? (Q2 2023 EV / EBITDA)

Notable Industrial & Construction Services Transactions Q2 | 2023

United Rentals, the largest equipment rental company in the world, has acquired ChaseCo Rentals, a leading independent general rental equipment provider. Founded in 2004, ChaseCo Rentals quickly distinguished itself with customers by providing the highest quality rental equipment and unsurpassed customer service throughout central and eastern Missouri provider. United Rentals will take the ChaseCo platform to the next level by providing its customers and team with further investment in growth.

Rental Equipment Investment Corp. (REIC), a portfolio company of Kinderhook Industries, has acquired Aim High, an aerial equipment rental, sales, and service company. Headquartered in Brighton, CO, Aim High is a full-service aerial rental business providing a variety of lift equipment to the Denver metropolitan area. The acquisition of Aim High will enable REIC to better serve its customers with additional equipment. Aim High represents REIC’s seventh add-on acquisition under Kinderhook’s ownership and the company’s 19th overall.

Sunbelt Rentals, an equipment rental provider for commercial, industrial, residential, and municipal industries, has acquired the assets of R&R Rentals, a three-location equipment rental company located in the greater Seattle area. R&R Rentals began its journey in the rental industry by acquiring Bellevue Rentals in 2002. The company expanded with the acquisition of Crystal Rentals in North Bend, WA, in 2003, and opened its Renton, WA, location in 2004. The acquisition of R&R Rentals expands Sunbelt Rentals’ presence in the Seattle area and reinforces its position in the equipment rental market.

CES Power LLC, a provider of sustainable mobile power generation, distribution, and temperature control solutions for large events, has acquired Immedia Event Productions, a key player in the northeastern events sector known for its robust power and HVAC solutions. This strategic alignment will provide a new hub in New England, strengthening CES Power’s capabilities in Boston and solidifying its commitment to strengthening services in the Northeast. CES Power is backed by industrial-focused private equity firm Allied Industrial Partners. Immedia marks the Company’s sixth bolt-on acquisition in the Northeast U.S. market.

Bigge Crane and Rigging Co., one of the nation’s largest crane sales and rental companies, has acquired a majority stake in Empire Crane Co. Empire Crane Co. is a full-service crane sales and repair company headquartered in upstate New York. The alliance between Empire and Bigge’s “Perfect Fleet” of more than 1,800 cranes and 21 maintenance facilities is now more readily available to customers on the East Coast. This new partnership is an essential milestone for both companies, which will benefit crane buyers worldwide with a true coast-to-coast offering.

Thompson Pump, a provider of multiple models of dewatering pumps with a focus on rotary and piston pumps, as well as vacuum-assisted models, for wellpoint and sock underdrain, has acquired American Sock & Dewatering, the premier socking company in Northern Florida. With the addition of American Sock, Thompson Pump is able to improve the customer experience by now providing the full range of construction dewatering services. This allows Thompson Pump to meet the unique North Florida challenges such as low-lying terrain, coastal areas, and heavy rain and flooding.

Industrial and Construction Services Public Valuation Index

Middle Market Valuation Multiples

Industrial and Construction Services News

Nonresidential Construction Spending Decreasing for the First Time in Nearly a Year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion. Spending declined on a monthly basis in nine of the 16 nonresidential subcategories. Private nonresidential spending fell 0.3%, while public nonresidential construction spending increased 0.1% in May. Contractors remain relatively upbeat, according to ABC’s Construction Confidence Index, and ongoing strength in manufacturing and publicly financed segments justifies that confidence. [LINK]

Construction Expert Predicts Flat Material Prices for the Second Half of the Year

Labor shortages, a manufacturing boom, and infrastructure work are keeping the industry from returning to pre-pandemic price levels. Nonresidential construction activity is maintaining price pressures on concrete, steel, and other key materials. Overall, current projections are that prices will remain flat for the second half of the year. Current trends show us returning to the prices that were seen in December and January and remaining flat from there through 2023. Of course, prices on certain commodities could go up. Products that require a lot of energy to produce may also become more expensive. In addition, future risks in the oil market, with OPEC cutting oil production will raise energy costs specifically, which means costlier steel and concrete. Turkey will raise demand for oil and other materials as they recover and look to rebuild after the recent devastating earthquakes. [LINK]

Public Projects Surge While Private Project Starts Falter

Total construction starts continued their 2023 roller coaster ride, jumping 8% in May to a seasonally adjusted annual rate of $1.11 trillion due to strong gains in manufacturing and infrastructure, according to Dodge Construction Network. After an unexpected 68% drop in manufacturing project kickoffs in April dragged down all starts, manufacturing starts more than doubled in May. Growth in the manufacturing and infrastructure sectors, however, was largely offset by contractions in commercial and residential construction — think office, retail and housing — marking an overall bifurcation of building activity. While construction in manufacturing and infrastructure report strong activity, the private sectors of the building market are posting worrying signs, as they struggle under the weight of higher interest rates, tightening lending standards and declining demand. [LINK]

Increased Optimism Drives the American Rental Association’s Quarterly Forecast

The American Rental Association indicates in its updated forecast that the United States equipment rental industry’s growth will soften but remain positive. Last quarter, the year-over-year growth was expected to be 4.7 percent in 2023 and 2.1 percent in 2024. The most current projections indicate 7.6 percent growth in 2023 totaling $60.4 billion in construction and general tool rental revenue. As for 2024, a 3.1 percent revenue increase is now expected. However, investment in the construction industry and construction employment approaches a record high. Also evident is the adaptability of rental companies. [LINK]