Packaging Newsletter – Q2 2022

Packaging Trends

Mid-year 2022 is a tale of pluses and minuses, with some new concerns in the packaging segments.

Plus: Most companies are seeing an upswing in orders and profitability as increases in material costs have been fully passed through to customers.

Minus: Sourcing labor and keeping wages in check continues to be a challenge (although we are seeing some small/early signs of easing).

Plus: Volatile markets tend to send acquirers towards conventional manufacturing assets, and middle-market packaging falls squarely into this category.

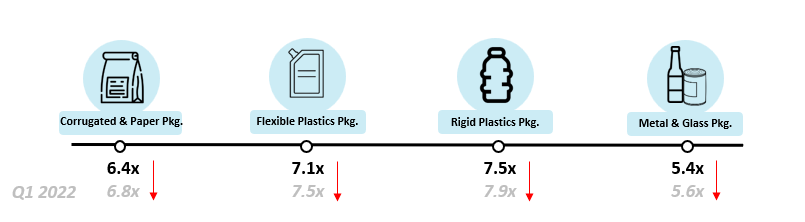

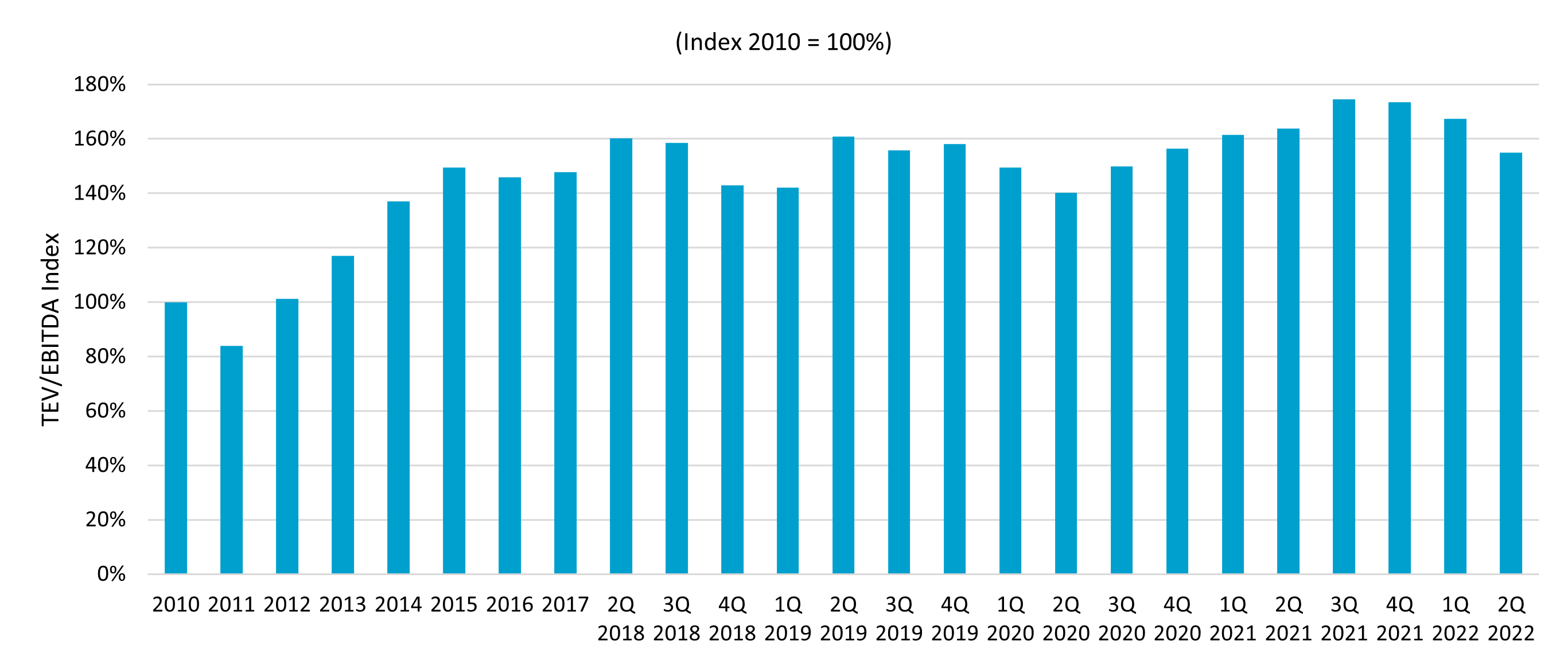

Minus: Despite robust deal volume in 2022 and continued interest from buyers, all packaging subsectors in the TKO Miller Middle Market Index are showing some softening.

Despite some slight softening in the packaging valuations, we continue to be bullish in the packaging industry. Packaging is generally less cyclical and consistently produces cash flows – traits that will drive interest from both strategic and financial buyers into the second half of 2022. Certain subsectors, such as labels, are seeing rapid consolidation with several private equity driven roll-ups occurring in the market. We are also seeing consolidation occurring around stand-up pouches throughout 2022.

Where Are Packaging Subsectors Valued? (EV/EBITDA)

Source: TKO Miller’s Proprietary Middle Market Flexible Packaging Index

Recent Packaging News

Inflation Affects on Packaging Material Costs in 2022

According to a new report from Rabobank that covers the 12-month inflation outlook in North America, packaging materials, including plastic, paper, glass, and aluminum will continue to experience rising inflationary pressures leading to double-digit price increases, with food packaging being a major contributor. U.S. consumer retail demand remains strong. Total retail sales achieved a 10.3% CAGR in the past two years, with more goods requiring more packaging than before. In many cases, demand exceeded the growth in packaging production, leading to a tight food packaging market with high operating rates across various materials, such as beverage cans, corrugated boxes, and PET milk bottles. Meanwhile, cost inflation is increasingly hitting the packaging sector due to increases in energy, transportation, and labor costs. Along with the ongoing conflict between Russia and Ukraine, these factors will lead to continued price increases of food packaging in the next 12 months. [LINK]

Flexible Packaging Market Size Worth $373.3 Billion by 2030

The global flexible packaging market size is expected to reach $373.3 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.5% from 2022 to 2030. Growing consumer driven demand for packaged food and beverage products owing to their convenience and ease of consumption is expected to drive market growth. [LINK]

Stand-Up Pouch Market is Estimated to Rise at a CAGR of 6.8%

New research from Transparency Market Research (TMR) found that the value of the global stand-up pouch market stood at $4.5 billion in 2021. The global market is expected to expand at a CAGR of 6.8% during the period from 2022 to 2026, surpassing a valuation of $6.3 billion by 2026. The global stand-up pouch market is expected to grow as the beverage, food, and healthcare industries flourish throughout the world. Furthermore, manufacturers and consumers are transitioning from conventional packaging solutions toward flexible packaging options like stand-up pouches due to their multiple advantages, according to the study. [LINK]

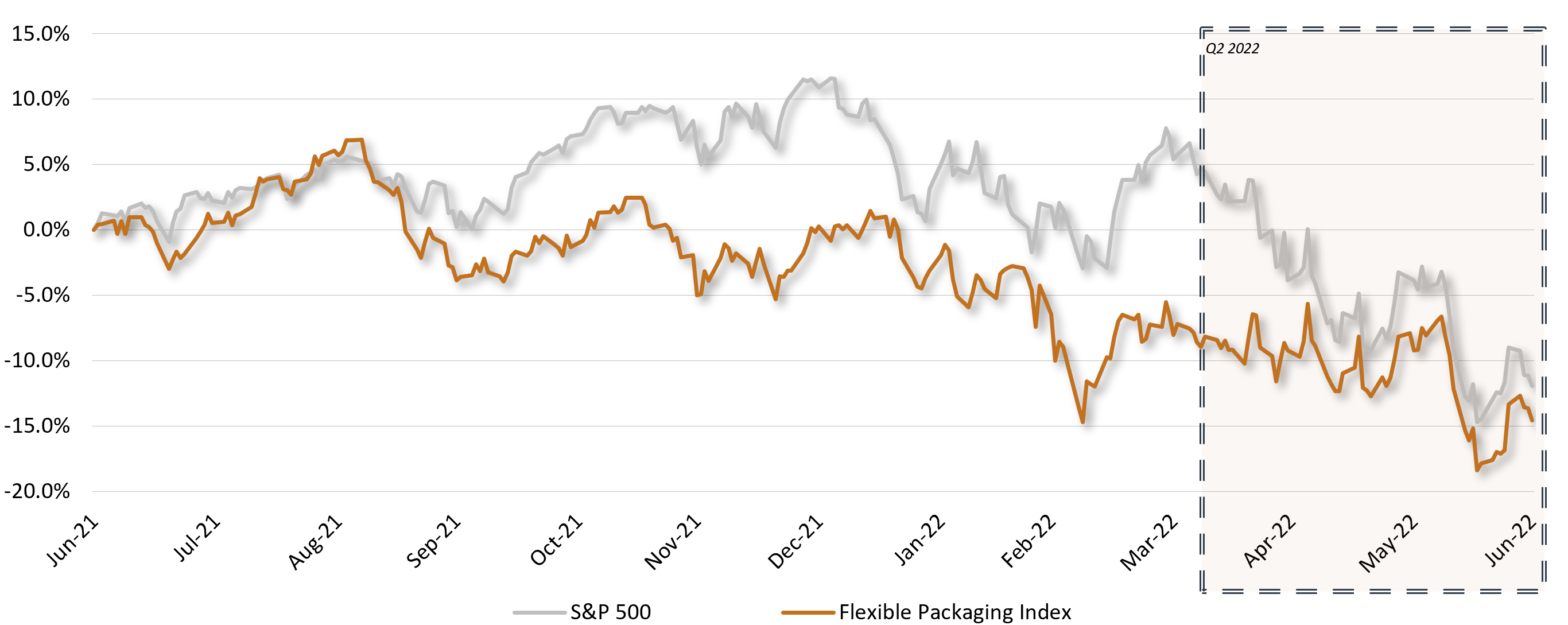

Flexible Packaging Market Performance vs S&P 500

Flexible Packaging Valuation Index

Source: TKO Miller’s Proprietary Flexible Packaging Valuation Index

Recent Packaging Transactions

April 2022 – TricorBraun Flex Acquires PBFY Flexible Packaging

TricorBraun Flex is a global leader in stock and custom printed flexible packaging, has acquired PBFY Flexible Packaging, a full-service flexible packaging distributor with ancillary manufacturing capabilities. The acquisition expands TricorBraun’s award-winning flexible packaging division, TricorBraun Flex. California-based PBFY has provided flexible packaging services for many well-known brands in the food, coffee, tea, and health and beauty markets for nearly 15 years. The company now operates as PBFY, a TricorBraun company.

May 2022 – ProAmpac Acquires Specialty Packaging

ProAmpac, a leading global flexible packaging company with a comprehensive product offering, has acquired Texas-based Specialty Packaging Inc., a maker of film, foil and paper packaging. This is the latest in a series of acquisitions for ProAmpac in recent years, which is owned by Pritzker Private Capital. This acquisition further enhances ProAmpac’s leading position in the food packaging sector.

June 2022 – Fortis Solutions Group Acquires Anchor Printing

Fortis Solutions Group LLC, a leading provider of high impact printed packaging solutions and a portfolio company of Harvest Partners, has acquired Anchor Printing, a flexographic and offset printing specialist providing shrink sleeves, flexible packaging, and pressure sensitive labels across numerous industries. The synergies between the two companies will expand the businesses to even greater heights.

June 2022 – Syracuse Label & Surround Printing and Macaran Printed Products Acquire Van Alstine & Sons, Inc.

Syracuse Label & Surround Printing and Macaran Printed Products have acquired Van Alstine & Sons, Inc., a packaging solutions and equipment provider. The new organization will provide enhanced development and manufacturing capabilities, incorporating state-of-the-art label technologies along with improved economies of scale.

About TKO Miller

TKO Miller, LLC is an independent, advisory-focused, middle-market investment bank. With over 130 years of collective transaction experience, TKO Miller provides merger and acquisition and financial advisory services for privately-held and private-equity-owned businesses, with a special focus on family-and-founder-held businesses.

Flexible Packaging is one of TKO Miller’s core industry focuses, along with Consumer Products, Industrial Services, Manufacturing, Business Services, and Healthcare. After advising numerous flexible packaging and printing companies on M&A and financing transactions, TKO Miller’s professionals have developed deep industry knowledge and a broad contact network that accompanies their transaction expertise with privately-held companies.

TKO Miller aims to bring value to clients by combining outstanding people with a results-oriented, flexible approach to transactions. Our services include company sales, recapitalizations, asset divestitures, and management buyouts. TKO Miller has a generalist focus and has served clients in a wide range of industries, including manufacturing, business services, consumer products, and industrial products and services. For more information, visit our website www.tkomiller.com