Packaging Newsletter – Q2 2023

Packaging Trends

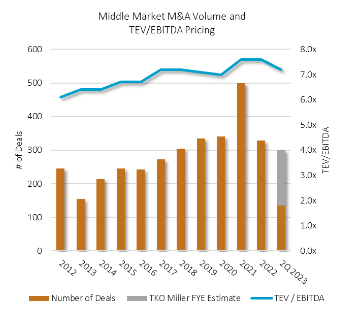

Q2 M&A Update

- U.S. middle market valuation multiples and deal volume are down slightly through Q2 of 2023.

- The S&P 500 Index is up 16.5% this year through June 2023, but middle market valuations are down approximately 8% based on the TKO Miller analysis.

- The best performing sectors year-to-date have been 1) technology, 2) business services, and 3) industrial maintenance.

- An 8% decrease in overall middle market valuations is a relatively small drop given buyers’ limited access to debt, increasing interest rates, and persistent inflation. Maintaining something even close to last year’s robust valuations demonstrates the resiliency of the middle market and buyers’ continued interest in transactions of this size (less than $500 million).

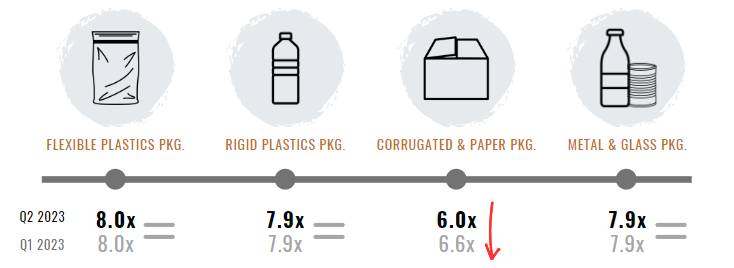

Q2 Industry Update

- A decrease in raw material packaging inputs has been a bright spot for manufacturers. Polypropylene prices are down 15% and polyethylene prices have dropped almost 8% over the last year, resulting in improved profitability for both flexible and rigid packaging. Paperboard prices have also come down significantly from their peak in late 2022.

- Despite dropping prices, a continued lack of demand has impacted several of the sectors we follow.

- Corrugated and paper packaging multiples are down, and box sales have decreased over 10% from last year. Transaction multiples have decreased from Q1 of this year, from 6.6x to 6.0x EBITDA.

- Other sectors have largely remained flat as strategic buyers focus on improving their own operations and bottom line before they wade back into acquisition mode.

Where Are Packaging Subsectors Valued? (TEV/EBITDA)

Source: TKO Miller’s Proprietary Middle Market Packaging Index

Paris Plastics Treaty Negotiations

Early this June, another round of the UN’s global plastics treaty negotiations concluded. Although some concerns from environmental groups remain, negotiations resulted in plans to create a draft of the treaty containing more specific language. The details of this next draft remain undecided, but discussions will soon specify global limitations regarding plastic usage. Potential plastic regulations could mean big changes for the flexible packaging industry. [LINK]

Artificial Intelligence in Packaging

The increasing presence of Artificial Intelligence in all aspects of the economy is undeniable, and the packaging sector is no exception to this trend. In an interview with Packaging Dive, cloud-based specification data platform Specright’s Chief Technology Officer, Ayman Shoukry, explained the importance of detailed data in effective AI usage for packaging. As AI becomes increasingly vital, packaging companies will be forced to modernize data organization and innovate longstanding systems to incorporate AI into predictive analysis, intelligent document processing, and even customer support processes. [LINK]

The Dip in Polypropylene Resin Prices

Polypropylene resin prices dropped significantly this past May. This decline can be largely attributed to weak demand, low polymer-grade propylene feedstock costs, and oversupplied polypropylene resin. PVC prices also fell due to the decrease in construction. PS prices, however, grew as a result of higher benzene feed stock prices. [LINK]

The Complicated Issue of Film Packaging & Recycling

Film has a lot of benefits when it comes to reducing the carbon footprint of packaging. Flexible packaging can also reduce the cost of needed goods in developing countries. However, it’s also more complex to recycle. That’s one reason that Ceflex, a European collaboration involving the flexible packaging supply chain, attended the plastics treaty talks in Paris last week and encouraged diplomats to include extended producer responsibility fees for flexible packaging to finance recycling programs. [LINK]

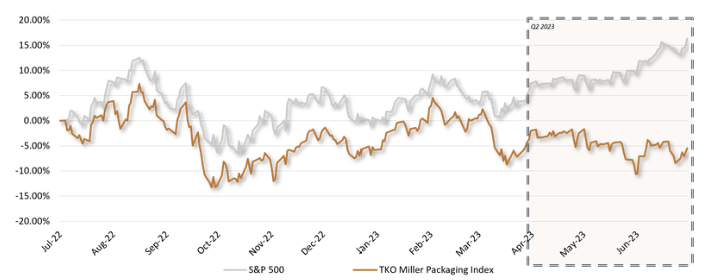

Packaging Market Performance vs S&P 500

Source: S&P Capital IQ, TKO Miller’s Proprietary Packaging Index

- Although the packaging industry has remained fairly steady over the past year, performance is still down slightly from July 2022

- The S&P 500 has been outperforming the industry as of late due to the significant rebound of large tech companies that dominate the index

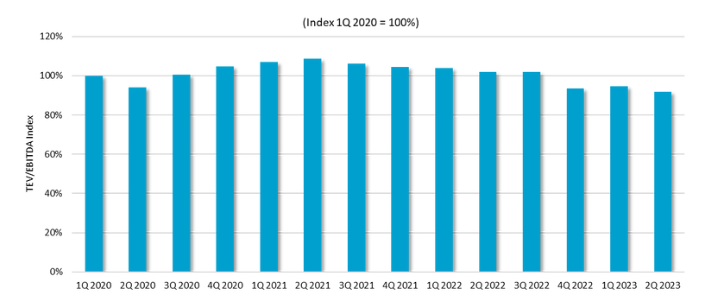

Packaging Public Company Trading Multiples (TEV/EBITDA)

Source: S&P Capital IQ, TKO Miller’s Proprietary Packaging Index

- Valuations have remained steady since the slight decline from all-time highs experienced in 2021

- Buyers still have ample capital to deploy and continue to look at packaging as a sustainable investment

Select Notable Packaging M&A Transactions | Q2 2023

TKO Miller Transaction Spotlight

TKO Miller Transaction Spotlight

Nassco, Inc., a distributor of janitorial, packaging, food service, and safety supplies and equipment, headquartered in New Berlin, WI, acquired Managed Packaging Systems, a custom packaging solutions provider headquartered in Hartland, WI. TKO Miller professionals advised Nassco on this acquisition.

DuPont de Nemours, an international chemical conglomerate that serves the electronics, transportation, construction, water, and healthcare markets, has acquired Spectrum Plastics Group, a recognized leader in advanced manufacturing of specialty medical devices and components, from AEA Investors. This acquisition will enhance DuPont’s existing offerings in biopharma, medical devices, and packaging through additional innovation and manufacturing capabilities.

AWT Labels & Packaging, a provider of custom labels, flexible packaging, and precision converting solutions, has acquired ASL Print FX, a provider of print solutions to beverage, consumer packaged goods, envelope, and promotional markets. AWT, based in Minneapolis, MN and owned by Morgan Stanley, has now made four bolt-on acquisitions since the private equity firm purchased the Company in 2022. This acquisition further expands AWT’s geographic footprint and enhances its existing printing solutions portfolio.

Resource Label Group (RLG), a leading provider of label and packaging solutions, has acquired Pharmaceutic Litho & Label Company (PLLC), a provider of labels and packaging solutions for the pharmaceutical, biotech, and medical device end markets. PLLC marks the 28th acquisition by RLG since its founding, which is based in Franklin, TN and currently owned by Ares Management. This acquisition is complementary to the Company’s recent acquisition of MedLit Solutions and further expands its capabilities in the pharmaceutical and healthcare industries.

CCL Industries, a global leader in specialty label, security, and packaging solutions, has acquired Pouch Partners, an Italian supplier of printed and laminated flexible films for the pouch industries. This acquisition adds a complementary product offering in pouches to the Company’s existing label and sleeve business and will become an integral part of CCL Label’s food & beverage unit in Europe. CCL targeted Pouch Partners as a solid foundation to enter the pouching market and could look towards developing a product line globally if successful.

PaperWorks, a leading provider of recycled paperboard and specialized folding cartons serving the food & beverage, personal care, and home care markets, has acquired The Standard Group, a converter of custom-printed paperboard packaging products for customers in food & beverage, consumer, and pharmaceutical industries. This acquisition enhances PaperWorks’ vertical integration capabilities, adds capacity, and is a complementary geographic fit with diverse end markets.

About TKO Miller

TKO Miller, LLC is an independent, advisory-focused, middle-market investment bank. With over 130 years of collective transaction experience, TKO Miller provides merger and acquisition and financial advisory services for privately-held and private-equity-owned businesses, with a special focus on family-and-founder-held businesses.

Flexible Packaging is one of TKO Miller’s core industry focuses, along with Consumer Products, Industrial Services, Manufacturing, Business Services, and Healthcare. After advising numerous flexible packaging and printing companies on M&A and financing transactions, TKO Miller’s professionals have developed deep industry knowledge and a broad contact network that accompanies their transaction expertise with privately-held companies.

TKO Miller aims to bring value to clients by combining outstanding people with a results-oriented, flexible approach to transactions. Our services include company sales, recapitalizations, asset divestitures, and management buyouts. TKO Miller has a generalist focus and has served clients in a wide range of industries, including manufacturing, business services, consumer products, and industrial products and services. For more information, visit our website www.tkomiller.com.