A Collaborative Business Sale – Now That’s a New One

An M&A transaction is the ultimate zero-sum game.

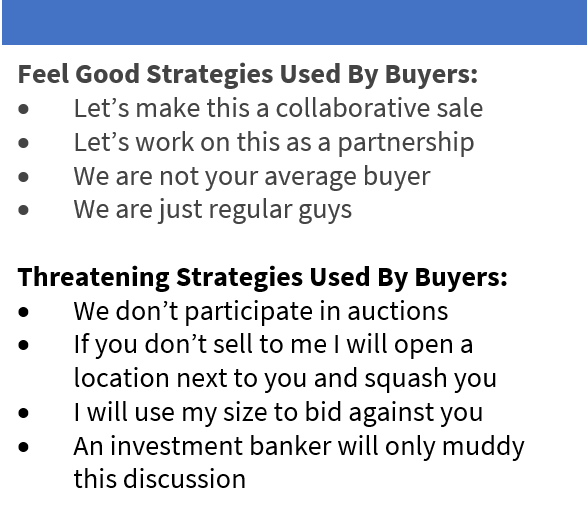

I was having a beer with a private equity buddy the other day and he was describing a number of M&A transactions he had come in contact with in 2019. In each case, I asked how many used an M&A advisor (investment banker), and in each case the answer was none. As we talked further, he used a term I had not heard before when describing a transaction, calling it a “collaborative sale”. I hadn’t heard this one before, but I quickly realized what it really was; it was just another creative name that buyers have come up with to make the unwary seller feel good about leaving money on the table in the transaction – to make a buyer feel as though he or she isn’t being a “good sport” if they don’t collaborate.

Keep in mind that an M&A transaction (the sale of a business) is the ultimate zero-sum game. By this I mean for every dollar a seller does not collect from the buyer he or she sells to, that he or she could otherwise have collected from a different buyer, is a transfer from that seller to his or her buyer. Let me outline it like this, this time with numbers. If Seller A’s business is worth $15 million (by “worth” I mean the value a buyer other than Buyer X would pay in a well run auction process), but Seller A sells to Buyer X for $10 million, Seller A has transferred that $5 million to Buyer X. Buyer X accomplishes this because he or she is very good at buying, while Seller A is a rookie, or an ill-informed seller. Technically, Buyer X in this case could turn around and sell the business he or she just bought from Seller A and monetize that $5 million, but whether he or she does this or not, Buyer X has been enriched by $5 million.

One area where we see this phenomenon is evident in society is in the sale of a house (usually by cash strapped or desperate sellers) for cash on an expedited basis. The old “I buy ugly houses” play. Most people do not sell their houses for cash on an expedited basis, they take their time, hire a realtor, and maximize the value. But if we look closely, when they sell their business without talking to other buyers, they are acting very much like the home seller who sells to the cash buyer. They limit their sales process and take the deal that is most available without hiring a professional to seek out other buyers (like most do in the sale of their homes) and check the price for their business. I want to be careful here when I compare the sale of a home to the sale of a business. If done properly, the sale of a business is much more complicated and involved, however, the underlying premise is the same, (1) hire a professional, (2) who knows the market, (3) to attract a broad pool of buyers, (4) to create competition, and to (5) drive and capture value. Why do business owners forget this process when it comes time to sell their business?

One area where we see this phenomenon is evident in society is in the sale of a house (usually by cash strapped or desperate sellers) for cash on an expedited basis. The old “I buy ugly houses” play. Most people do not sell their houses for cash on an expedited basis, they take their time, hire a realtor, and maximize the value. But if we look closely, when they sell their business without talking to other buyers, they are acting very much like the home seller who sells to the cash buyer. They limit their sales process and take the deal that is most available without hiring a professional to seek out other buyers (like most do in the sale of their homes) and check the price for their business. I want to be careful here when I compare the sale of a home to the sale of a business. If done properly, the sale of a business is much more complicated and involved, however, the underlying premise is the same, (1) hire a professional, (2) who knows the market, (3) to attract a broad pool of buyers, (4) to create competition, and to (5) drive and capture value. Why do business owners forget this process when it comes time to sell their business?