Industrial and Construction Services Newsletter – Q1 2022

TKO Miller Market Analysis

Industrial and Construction Services

- Inflation and labor shortages remain the biggest issues on the minds of most business leaders, and industrial and construction services are no exception

- These issues are compounded by continued shortages of skilled labor and the accelerated retirement of senior leadership/project management personnel

- That said, demand for industrial maintenance services is extremely strong, with many managers reporting record backlogs in 2022

- Commercial refurbishments/inspections as well as small scale new construction projects, are also performing well

- New high-rise construction, however, appears to be facing some slowdown; project delays have impacted contractor performance, but future backlogs are still holding firm, indicating projects are not being canceled

M&A Conditions

- Following a record M&A year across most industry segments in 2021, M&A activity remains elevated in 2022

- A rush of deals trying to close by year-end 2021 created something of a log jam, which lead to a slow start for new transactions in 2022; activity has since picked back up as Q1 2022 came to a close

- Although TKO Miller professionals don’t expect 2022 to necessarily beat 2021’s record activity level, it is reasonable to believe a combination of seller demographics and buyer demand will continue to drive heavy deal volume

- A rising interest rate environment may further encourage heightened deal activity in the first half of 2022 as buyers push to deploy capital and take advantage of currently low rates to finance transactions

TKO Miller Completed Transactions – Q1 2022

Target: Gearbox Express, LLC

Target: Gearbox Express, LLC

Target Headquarters: Mukwonago, WI

Acquirer: RNWBL, LLC, a portfolio company of CSL Capital Management, L.P.

Acquirer Headquarters: Houston, TX

Target Description: Gearbox Express, LLC is a provider of highly-engineered maintenance and refurbishment solutions to the wind energy market

Target: Power Test, Inc.

Target: Power Test, Inc.

Target Headquarters: Sussex, WI

Acquirer: StoneTree Investment Partners

Acquirer Headquarters: Dallas, TX

Target Description: Power Test is an industry leader in the design, manufacture, and sale of dynamometers, heavy equipment testing systems, and related data acquisition and control systems.

Target: Horsfield Companies, Inc.

Target: Horsfield Companies, Inc.

Target Headquarters: Epworth, IA

Acquirer: BARD Materials

Acquirer Headquarters: Dyersville, IA

Target Description: Horsfield Companies is a vertically integrated, premier provider of concrete and concrete-related materials and services to the Midwest construction industry.

[PRESS RELEASE]

Industrial and Construction Services Transactions

January 2022 – Power Equipment Company Acquires Golden Equipment Company

Power Equipment Company, a provider of heavy equipment sales and rental solutions for owners and operators in the aggregate, construction, crane, and paving compaction industries has acquired Golden Equipment Company, a provider of innovative solutions for the construction, mining, and agricultural industries. The acquisition bolsters Power Equipment Company’s presence in New Mexico and southwestern Colorado with additional equipment and support solutions in the rolling stock, compact, aggregate, crane, and paving and compaction segments of the construction market.

February 2022 – Sunbelt Rentals, Inc. Acquires ComRent International LLC

Sunbelt Rentals, a premier rental equipment company in North America offering a highly diversified product mix, has acquired ComRent International, a U.S.-based power-testing infrastructure provider specializing in load bank solutions for more than two decades. Sunbelt Rentals purchased Comrent from the Global Environment Fund (GEF), a U.S.-based private equity firm investing growth capital in companies that promote sustainability. Sunbelt plans to leverage Comrent’s unique position in the market to grow its digital infrastructure business, while also forging a path in renewable energy, enabling growth in critical markets such as solar, wind, and microgrids.

March 2022 – Construction Partners, Inc. Acquires Southern Asphalt, Inc.

Construction Partners, Inc., a vertically integrated civil infrastructure company specializing in the construction and maintenance of roadways across five southeastern states, has acquired Southern Asphalt, Inc., a provider of commercial, industrial, and subdivision projects in the areas of asphalt paving, resurfacing, pavement markings, sealcoating, and light grading. This acquisition will allow Construction Partners to enter a new and dynamic market and add an experienced team of paving professionals.

March 2022 – American Pavement Preservation, LLC Acquires Southwest Slurry Seal, Inc.

American Pavement Preservation, LLC, a portfolio company of Capital Alignment Partners, has acquired Southwest Slurry Seal, Inc. American Pavement Preservation is a provider of asphalt pavement placement and maintenance services, including asphalt laying for highways, residential subdivisions, commercial projects, and parking lots. Southwest Slurry Seal offers pavement preservation services, including commercial slurry seal, micro-surfacing, crack sealing, and seal coating contracting services.

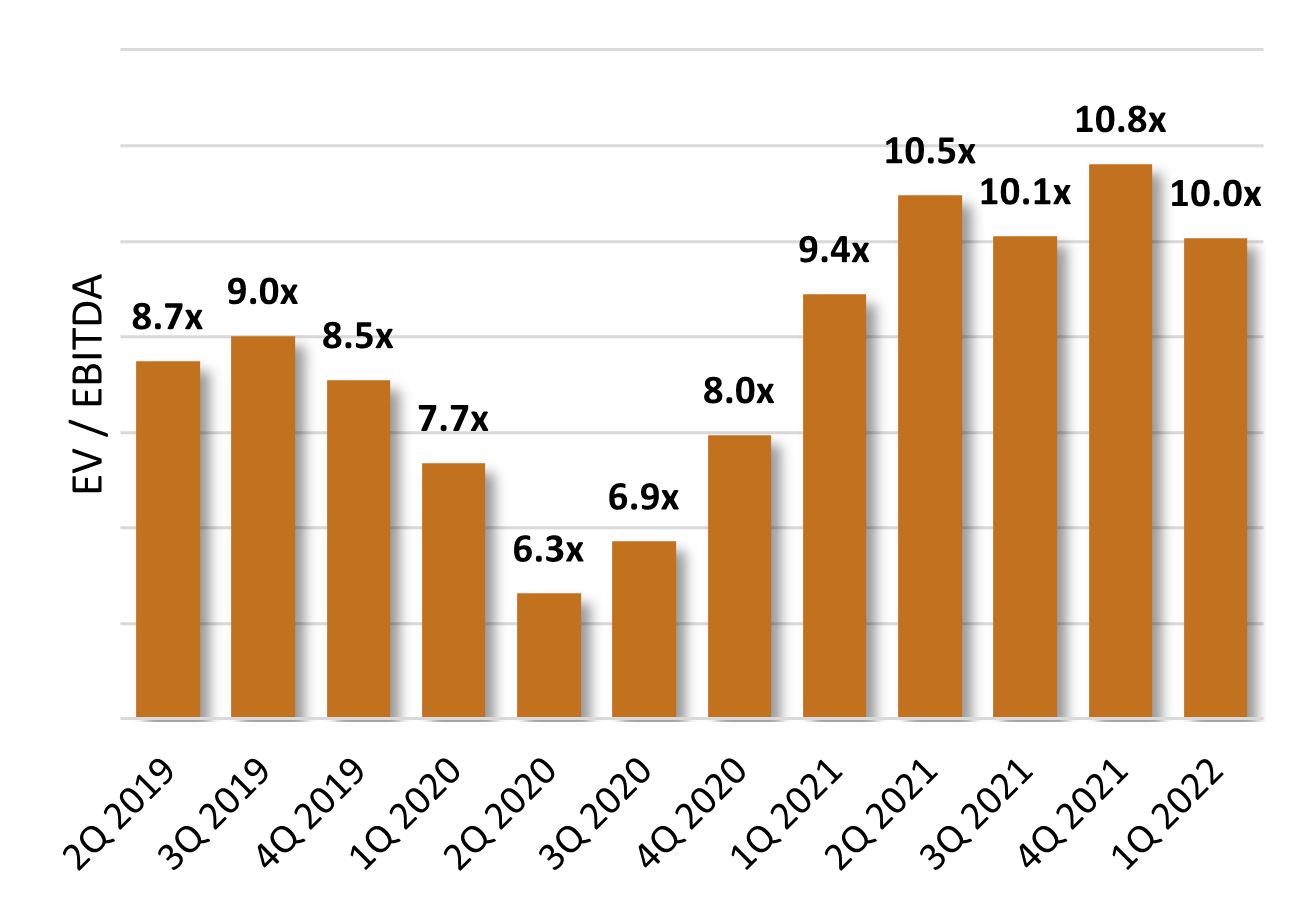

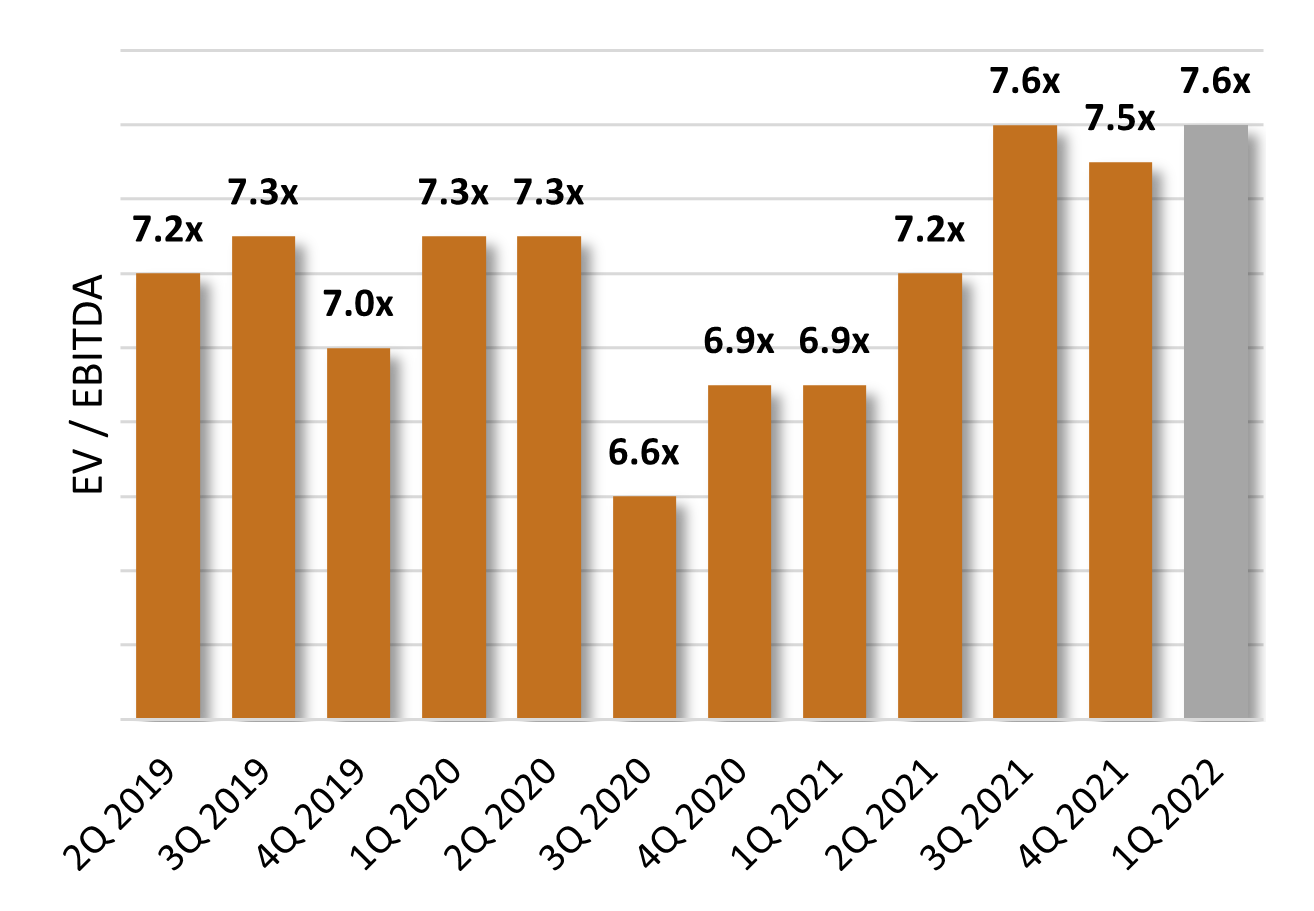

Industrial and Construction Services Valuation Index

Note: Companies with outlying multiples due to financial inconsistencies have been excluded to avoid skewing data

Middle Market Valuation Multiples

Source: GF Data

Industrial and Construction Services News

Ukraine War Compounds Supply Chain Issues in the Construction Industry

Russia is a major producer of aluminum and copper, materials that already saw a year-over-year price increase of 33% and 25%, respectively, in January. That means prices for materials forged from those metals could balloon even higher. The added pressures from the incursion come at a time when U.S. construction and shipping costs were already rising. Supply shortages, worsened by surging demand, have led to the largest annual spike of input prices to construction since 1987, when data collection began. [LINK]

Labor Shortages and Demographics Jeopardize Construction Industry Recovery

The continued labor shortages have resulted in rising wages as contractors compete for workers. Over the past 12 months, construction wages climbed 5.1 percent, increasing $0.19 in January 2022 alone. In addition, construction input prices have also increased. These challenges not only squeeze industry margins, but they jeopardize industry recovery altogether as project owners are being forced to delay or cancel projects due to elevated bids. [LINK]

The American Rental Association Predicts a 12 Percent Increase in Construction and Industrial Equipment Rental Revenue in 2022

Construction and industrial equipment rental revenue is expected to lead the way with a 12 percent increase in 2022 to $38.9 billion, while general tool is expected to grow by 5 percent to reach $13.9 billion this year. The largest uncertainty facing the industry that could impact the U.S. forecast is the current rate of inflation, which was recently reported to be 7.5 percent year-over-year. Although supply chain issues have caused delays in delivery of fleet to equipment rental companies, the ARA forecast projects a 36.7 percent increase in investment in inventory to reach $14.4 billion in 2022, exceeding the previous annual high of nearly $13.8 billion spend in 2019. [LINK]

U.S. Infrastructure Diversity Plan Draws Fire From Contractors, Minority Groups

The U.S. Infrastructure Diversity Plan was proposed to create good-paying jobs, with the choice to join a union, for workers in traditionally underserved communities, however, there is concern that it would favor union partnerships and project labor agreements in grant decisions. PLAs are like collective bargaining agreements but apply to a single project and are agreed upon by all parties: general contractors, subcontractors, and labor groups. Last month, President Joe Biden issued an executive order mandating PLAs on federal contracts of $35 million or more. While PLAs don’t specifically cut non-union contractors out of federal projects, they’re often perceived by construction employers’ groups as doing so. The results within the industry are hiring practices that neglect to include underrepresented contractors along with billions of dollars in contracts, with only small percentages going to women and minority firms. [LINK]

DOL Proposes New Davis-Bacon Rules

Secretary of Labor, Marty Walsh rolled out new rulemaking proposals for the first time in nearly 40 years to change the Davis-Bacon Act, which sets the prevailing wages contractors must pay workers on federal projects. The Davis-Bacon Act uses pay surveys administered by the DOL to set the prevailing wage in a federally funded project’s location. It impacts $217 billion in federal spending annually and 1.2 million construction workers. Under the current process, at least 51% of surveyed wages need to be within a “same or similar” margin. If they’re not, the weighted average — as opposed to a simple average — of all wages is used. That means more frequent occurrences of low wages could drag down the overall rate. This raises concerns for contractors as those weighted averages are not reflective of actual wages paid to workers on construction projects in a particular local community. Instead, Ben Brubeck, vice president of regulatory, labor and state affairs at Associated Builders and Contractors, suggested using Bureau of Labor Statistics data to determine prevailing wages for a given position and location. [LINK]