Industrial and Construction Services Newsletter – Q1 2023

TKO Miller Market Analysis

Industrial and Construction Services

- Supply chain disruptions and tight skilled labor market conditions over the past several years have led to large backlogs in both commercial construction and industrial maintenance/capital spending

- Industrial maintenance/construction margins continue to improve as inflationary pressures ease and new projects are priced at higher labor/material rates

- As a result, Industrial CAPEX forecasts for 2023 and 2024 appear very robust

- Recent banking turmoil has made many regional lenders more conservative in how they approach new loans

- While many of the commercial projects currently underway or beginning construction in 2023 have already secured financing, projects in earlier stages may face funding challenges as lenders pull back

- The outlook for commercial construction volume in 2023 and the first half of 2024 remains strong, the likelihood of a slowdown increases beyond that

M&A Conditions

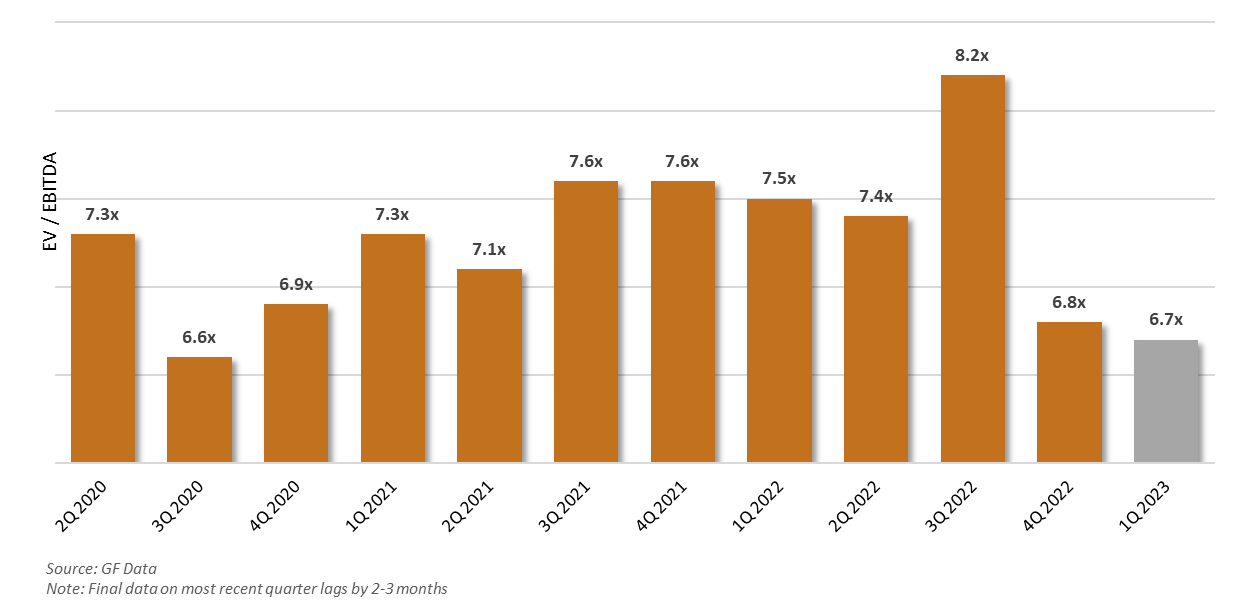

- Global M&A continues its slump in 1Q23 (deal volume fell short of 1Q22 levels by 17%), which is impacting multiples and consequently overall deal valuations (middle market valuations fell significantly in 4Q22 and are expected to continue falling)

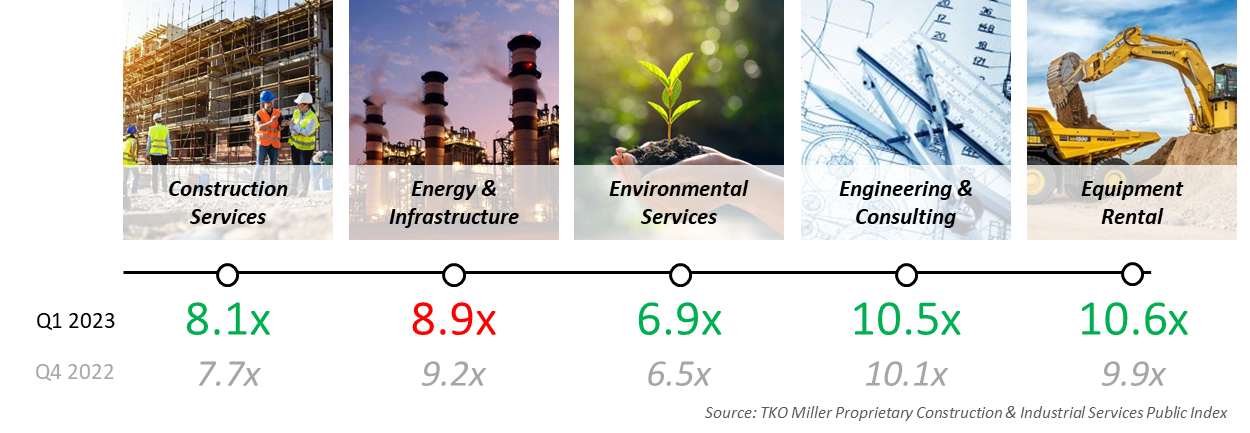

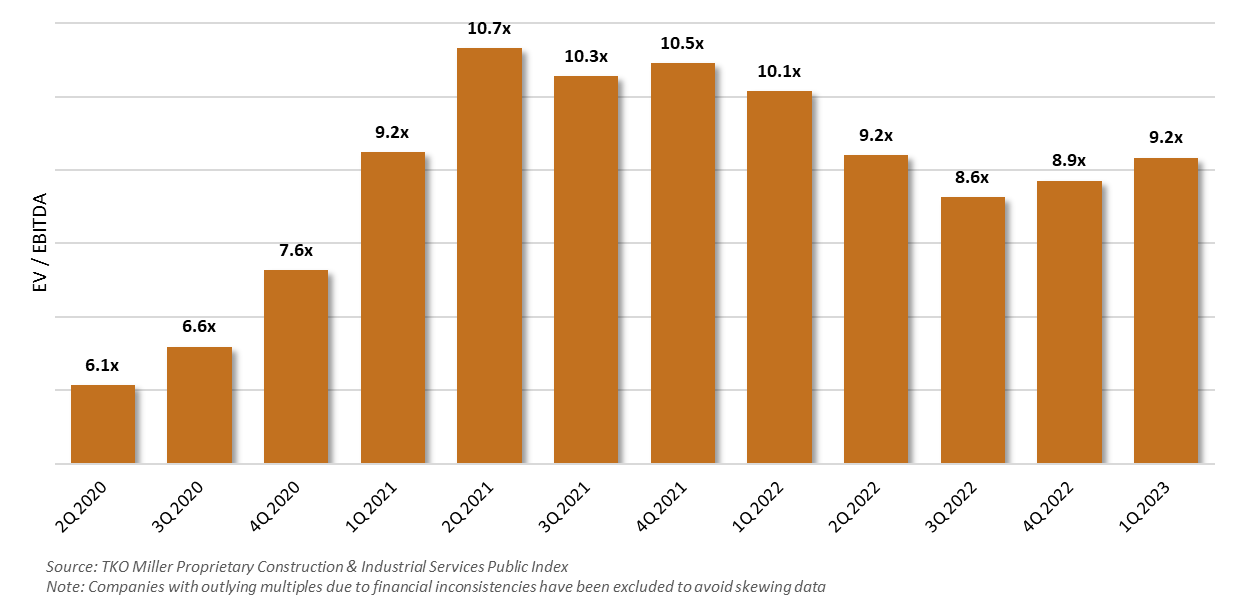

- Interestingly, public multiples in every Industrial and Construction services subsector we follow except for energy and infrastructure increased in 1Q23 compared to 4Q22 (aided by a strong start within public equities), yet overall industry multiples remain lower compared to a year ago

- Industrial services remains a hot target sector for both strategic and financial buyers, and both are prepared to aggressively pursue attractive deals, but so far assets in the market remain scarce

- Debt markets have become more challenging, resulting in lower leverage availability for M&A deals; this is forcing buyers to get creative and utilize more equity or higher-priced mezzanine debt to remain competitive on valuations

- Industrial/construction service M&A activity in 1Q23 was steady but uneventful; most transactions that closed were smaller tuck-in deals

- We expect volume to pick up in the second half of the year as debt markets stabilize and transactions that have been held back or slow-played start coming to market

Jim Rogers’ Industry Spotlight

- Port Arther, TX LNG Phase 1 launched in March 2023. The project is fully permitted and will create

opportunities for construction through 2027. Projected CAPEX of $13B and 5,000 jobs created during construction

opportunities for construction through 2027. Projected CAPEX of $13B and 5,000 jobs created during construction - Significant challenges are ahead in financing commercial real estate. $1.5 Trillion of low interest debt will mature in 2023 & 2024. Any refinanced loans will carry significantly higher rates. But… commercial real estate values have declined 25% in the past year and many of the loans are already underwater. Brookfield and PIMCO defaulted on over $2.6B in loans this year

- Dodge Momentum Index showed softening in 1Q23. This is a leading indicator of construction activity looking out 12-18 months. While the index remains generally strong, we could be facing some difficult comps in the first half of 2024 compared to 2023

- Non-building (utility/gas plants, infrastructure, public works) construction starts showed robust growth of 21% on a rolling 12-month basis

- United Rentals showed strong organic growth in Q1 of 16.6% and robust improvement in equipment utilization. Although they fell short of analyst projections, the growth is a good bellwether on overall construction activity

Where Are Industrial & Construction Subsectors Valued? (Q1 2023 EV / EBITDA)

Notable Industrial & Construction Services Transactions Q1 | 2023

Rental Equipment Investment Corp., a portfolio company of Kinderhook Industries LLC, has acquired Black Mountain Rentals Inc. Headquartered in Pinedale, WY, Black Mountain Rentals is a provider of general rental equipment primarily serving residential contractors, homeowners, and commercial contractors. REIC is a multi-regional rental equipment services platform offering a broad selection of general and specialty rental equipment. This represents REIC’s fifth add-on acquisition under Kinderhook’s ownership.

United Rentals, the largest equipment rental company in the world, has acquired ABLE Equipment Rental, a privately owned, independent equipment rental with nine locations along East Coast. Operating since 1996, ABLE has experienced significant growth over the years – from 2021 to 2022 alone, it grew its aerial fleet by nearly 20 percent, jumping from 3,829 units to 4,585. It also made key acquisitions in 2022, having brought on Elite Construction Rentals and Extreme Rentals USA.

Sunbelt Rentals, an equipment rental provider for commercial, industrial, residential, and municipal industries, has acquired Big Sky Rents & Events Inc., a general tool rental business headquartered in Kalispell, MT. In June 2022, Big Sky was recognized as one of the fastest growing rental companies in North America with reported growth of 121.4 percent from 2019 to 2021. In November 2021, the company moved into an impressive new facility in southern Kalispell custom built for Big Sky, which will be rebranded as Sunbelt.

Rental Equipment Investment Corp., a portfolio company of Kinderhook Industries, has acquired Industrial Drying Solutions LLC, a subsidiary of Power Rental Solutions LLC. Founded in 2020 and Headquartered in Franklin Park, IL, Industrial Drying Solutions is a provider of specialty rental equipment, including heating, dehumidification, and power solutions. The company has four locations. The acquisition provides Rental Equipment Investment Corp. substantial growth in their specialty rental division and enables the company to expand their geographic footprint and broaden their equipment offering.

Silver Oak Services Partners, a lower middle-market private equity firm based in Evanston, IL, has made an investment in Vecta Environmental Services, a diversified provider of mission-critical in-plant industrial services. Founded in 2011, Vecta provides hydroblasting, tank cleaning, chemical cleaning, hydroexcavation services, and industrial insulation and scaffolding services. Headquartered in Gonzales, LA, Vecta operates eight locations throughout the Gulf Coast and Southeast U.S. servicing industrial, utility, chemical, and midstream & downstream energy customers.

Best Line Equipment, a leading equipment dealer and general rental, sales, service, and parts provider to the construction and industrial industries, has acquired Chesapeake Supply & Equipment Co., Mid-Atlantic’s single source provider of construction equipment and supplies. This acquisition allows Best Line to serve its long-term strategic goal of stability first and growth second. This acquisition also marks Best Line Equipment’s 14th equipment location in three different states and its first in the Baltimore / Washington D.C. market.

Industrial and Construction Services Public Valuation Index

Middle Market Valuation Multiples

Industrial and Construction Services News

Backlog Ticks Up, Remains Historically Elevated

Construction backlog increased 0.2 months to 9.2 months in February despite concerns around financing, according to Associated Builders and Contractors. The backlog reading regained its 0.2-month loss from January and has hovered around highs for the past four months not seen since the start of the pandemic, according to the report. Although backlog remains at a historically elevated level, borrowing costs will continue to rise during the next several months, and contractors continue to struggle in the face of skilled labor shortages. [LINK]

Manufacturing Remains Lone Bright Spot for Construction Spending

National nonresidential construction spending increased 0.4% in February to a seasonally adjusted annualized basis of $982.2 billion according to an Associated Builders and Contractors analysis. Manufacturing projects predominantly accounted for the increase; spending in the other 15 nonresidential segments collectively declined in February. The nonresidential sector’s momentum is attributable to manufacturing-related construction, which accounted for nearly 35% of the year-over-year growth in spending. [LINK]

Recent Bank Failures Cause Uncertainty for Contractors

Pressure on America’s banks is fueling uncertainty in financial markets, causing concerns of a spillover to overall construction activity. After the recent closures of Silicon Valley Bank and Signature Bank, questions surfaced about how those collapses could impact the construction industry. Nonresidential construction activity this year has remained at high levels despite elevated construction and borrowing costs, according to an Associated Builders and Contractors analysis. However, contractors can expect tightening and some tension from small and regional banks. [LINK]

Construction Employment Increases in 45 States

Construction employment increased in 45 states in February compared with a year ago, according to analysis of federal employment data by the Associated General Contractors of America. Texas saw the largest number of jobs added, increasing by 37,900, or 5%, from February 2022 to February 2023. West Virginia saw the largest drop, losing 2,200 jobs, or 6.5%, over that time period. From January to February, construction employment increased in 24 states, held steady in six and declined in 20 and Washington, D.C. The Department of Labor has recently announced initiatives to train and employ women and minorities — underrepresented groups in construction — so that they can find a strong career path and fill the gap in demand. The agency hopes the Infrastructure Investment and Jobs Act will create an opportunity for workers seeking good-paying jobs, who then realize their future in construction. [LINK]

Manufacturers Raise the Bar on Safety to a Higher Standard

Improvements in safety have come about because participants at every level are contributing. The recent ANSI standards that have improved safety procedures were very much motivated by manufacturer involvement. Rental companies have made safety a much greater priority than ever before. Rental companies are far more diligent in making sure customers are thoroughly trained and ANSI standards require them to do site assessments and improve training and customer familiarization. [LINK]