Industrial and Construction Services Newsletter – Q2 2022

TKO Miller Market Analysis

Industrial and Construction Services

- The outlook for the broader economy, constriction included, remains murky

- Many contractors and lenders are bracing for a recession, or a slowdown, in the next 12-18 months

- Construction activity remains robust (particularly in certain regions), and backlogs are high, but uncertainty is causing concern for the future among many business owners

- Industrial maintenance backlogs are at all-time high across many contractors, as high energy prices have created strong cash flows, and several years of slowed/deferred work have created a capital spending boom

- Despite strong top lines, many industrial contractors are struggling with depressed margins, driven by competitive pricing during slow 2020/2021 periods and rapidly increasing material and labor costs (often outpacing the modest price escalators baked into long-term maintenance contracts)

M&A Conditions

- M&A activity across all sectors was extremely robust in Q2 2022, with many private equity firms reporting record inbound deal volume in May/June (even exceeding July/August 2021, which were previous high-water months)

- Construction-related and building products M&A activity has slowed somewhat from its peak, driven primarily by a cooling of interest in the previously hot building products sector

- Many buyers are anticipating a pullback in home building, which fueled the building products boom

- Industrial/facility services acquisitions continue to attract strong buyer demand and premium valuations

- Buyers are attracted to the critical, non-discretionary, and recurring nature of these businesses

- Higher-margin industrial/facility service companies are commanding particularly strong interest

Industrial and Construction Services Transactions

April 2022 – Highlander Partners Acquires Direct Scaffolding Supply

Highlander Partners, L.P., a Dallas-based private investment firm, has acquired Direct Scaffolding Supply (DSS), a manufacturer/distributor of scaffolding, shoring, and forming equipment. Headquartered in Houston, TX, DSS is one of the largest and most trusted scaffold suppliers globally. The acquisition also included DSS affiliated companies including DirecTank Environmental Products, GSD Logistics, Beric Valves and Direct Staging and Seating.

May 2022 – Rental Equipment Investment Corp. Acquires Total Construction Rentals

Rental Equipment Investment Corp., a portfolio company of Kinderhook Industries LLC, has acquired Total Construction Rentals Inc. REIC is an equipment rental holding company operating 33 locations and TCR is a specialty equipment rental company focused on the rental of heaters, air conditioners, coolers, fans and dehumidifiers. REIC’s acquisition of TCR accelerates its strategic growth in the specialty rental segment. Financial terms of the transaction were not disclosed.

May 2022 – AMECO Acquires F&M MAFCO

AMECO, a leading provider of construction and maintenance Site Services® planning and delivery, has acquired F&M MAFCO, an international supplier of tools and equipment rental, sales and service programs. The synergies between both companies will solve construction and maintenance industry challenges by improving the availability of materials, creating onsite labor efficiencies, reducing project costs and enhancing safety and sustainability efforts. F&M MAFCO will maintain a significant operations presence in Cincinnati, Ohio.

June 2022 – Sunbelt Rentals Acquires Amos Metz Rentals & Sales

Sunbelt Rentals has acquired Amos Metz Rentals & Sales, an equipment rental company located in Woodland, CA, after spending $1.3 billion on 25 bolt-on acquisitions in fiscal 2022 (ended April 30). Sunbelt continues its growth efforts in preparation for a robust growth economy in the United States, Canada and the United Kingdom while diversifying its end markets. The combined acquisitions added a total of 123 locations in North America during the year.

Where Are Industrial Subsectors Valued? (2Q 2022 EV / EBITDA)

All subsector valuations are lower than in 1Q22, indicating weaker outlook on the industry as a whole in the coming quarters. Uncertainty in these subsectors remains high and it is unclear if valuations will decline further or level off in the coming 12-18 months

Note: Multiples calculated using average EV / EBITDA over the previous 3-month period to avoid one-time variances in data

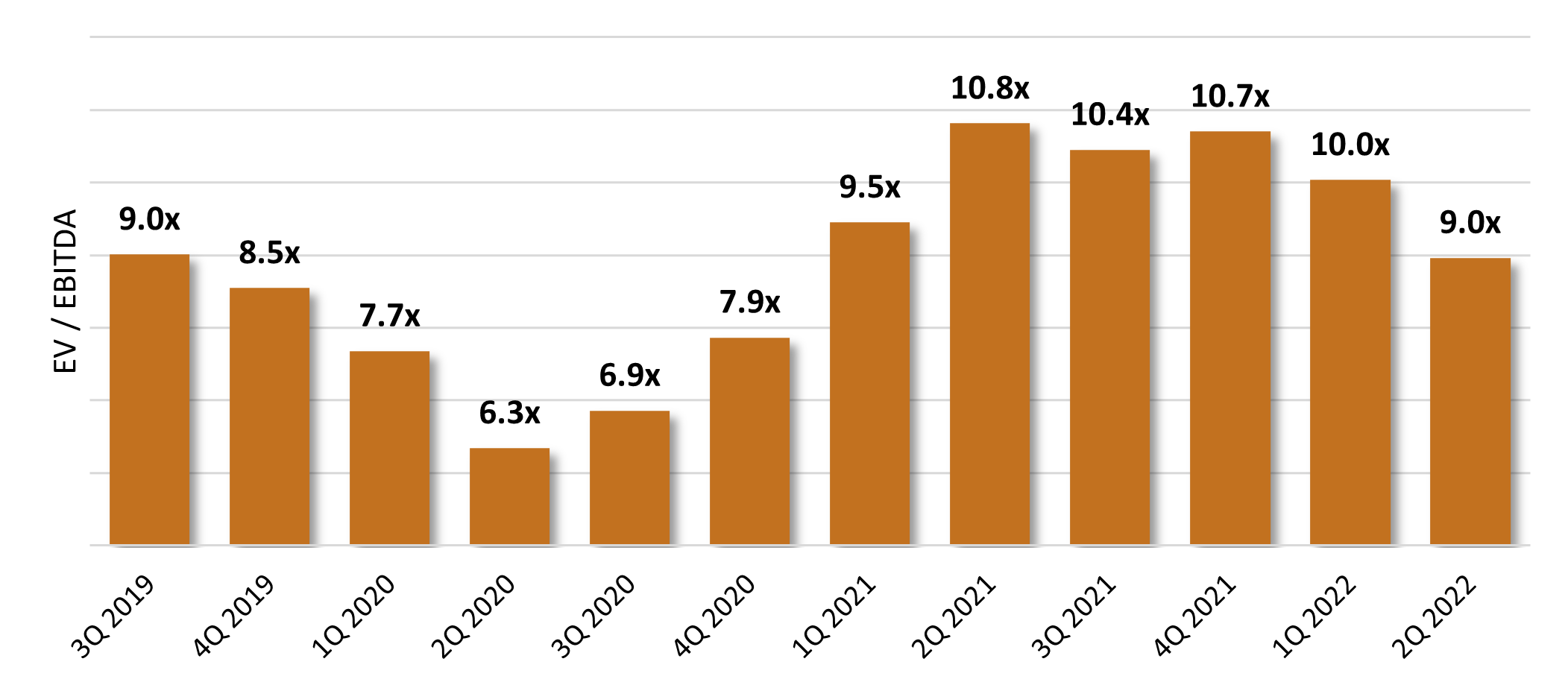

Industrial and Construction Services Valuation Index

Valuation multiples within the industrial and construction services industry continue to decline for the 2nd consecutive quarter. TKO Miller expects this trend to persist as rates rise and the likelihood of a recession grows.

Note: Companies with outlying multiples due to financial inconsistencies have been excluded to avoid skewing data

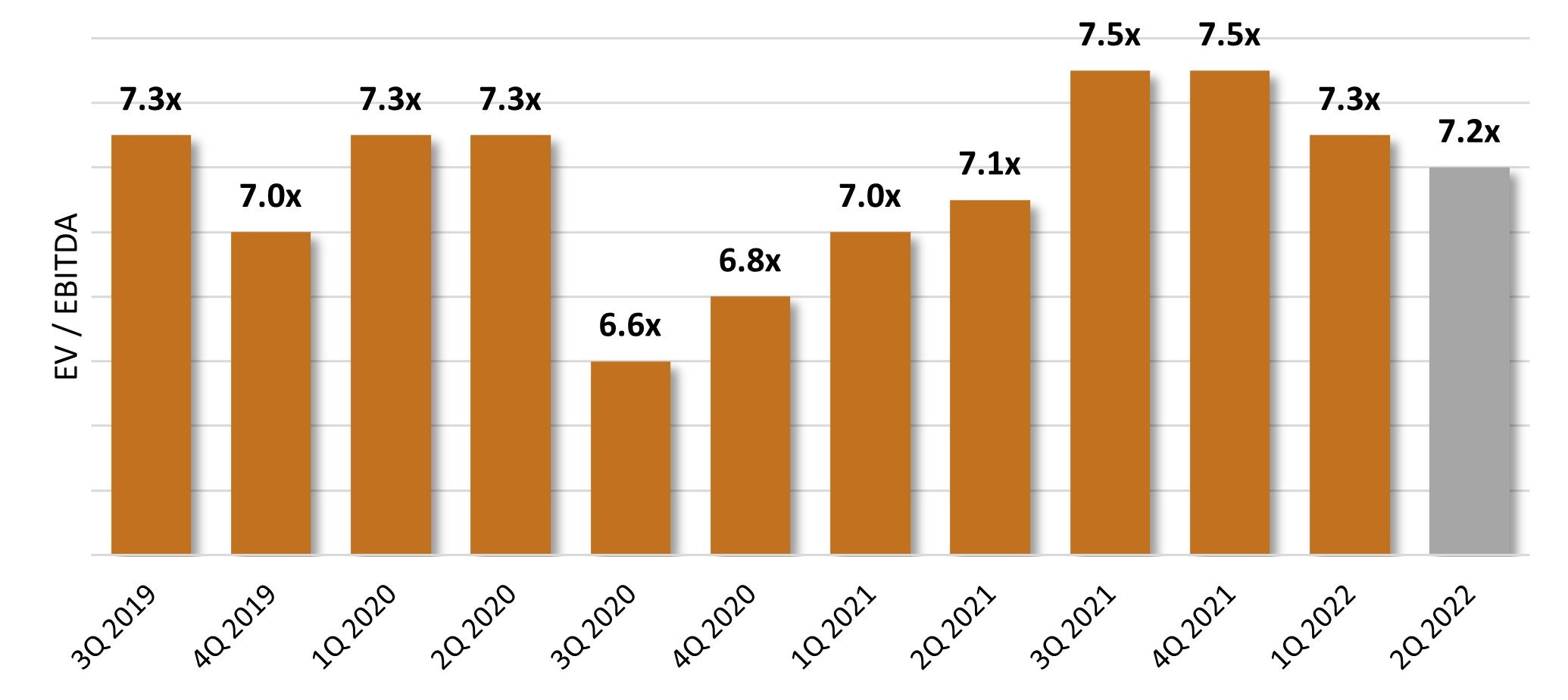

Middle Market Valuation Multiples

Middle market valuation multiples appear to be in lock step relative to its public industrial and construction services counterparts. With definitive Q2 data in the middle market lagging by 2-3 months, TKO Miller estimates that multiples have depressed further from 4Q21 highs, particularly in certain hard-hit industries. Note that the industrial and construction services index analyzes public company multiples, which tend to trade at premiums (roughly 25-35%) when compared to smaller companies in the middle market.

Source: GF Data

Note: Final data on most recent quarter lags by 2-3 months

Industrial and Construction Services News

Rising Labor Costs Eat Away at Construction Firms’ Profits

Average hourly earnings for production and non-supervisory employees in construction rose to $32.19 in May, according to the Bureau of Labor Statistics, a 6.3% increase from a year ago and the highest gain in 40 years. But increasingly, those higher wages are coming on the bottom rung of the construction employment ladder, with unskilled laborers seeing the greatest wage gains. That means construction companies pay more for hard-to-find workers, without necessarily reaping the benefits of increased productivity, or profits. As a result, even as contractors anticipate hiring more workers in the months ahead, they don’t anticipate profits going up, as they normally would while adding more employees to take on more jobs. [LINK]

Recession Watch: ABC Economists Predict ‘Difficult Times’ for Construction Industry

Rising prices, supply chain issues, and labor shortages continue to stand in the way of strong demand for nonresidential construction. For months, economists and others have been expecting inflation to peak and then subside, but with elevated energy prices across the economy affecting manufacturing and distribution, inflation is not expected to meaningfully subside anytime soon. The Federal Reserve, in turn, will continue to tighten monetary policy and raise interest rates, suppressing demand over the rest of the year. This dynamic has the potential to drive the economy into a recession either later this year or at some point in 2023. [LINK]

ABC’s Construction Backlog Rises in May; Contractor Confidence Falters

Associated Builders and Contractors’ (ABC) Construction Backlog Indicator increased to nine months in May from 8.8 months in April. Backlog in the infrastructure segment jumped from 8.7 months in April to 9.3 months in May, and the Northeast and South regions continue to outperform the Middle States and the West. For contractors, the challenge will continue to be input price volatility, the propensity of the labor force to shift jobs in large numbers, and equipment shortages and delays. The proportion of contractors who expect that profit margins will expand over the next six months is declining, a reflection of worsening supply chain challenges. [LINK]

Oil and Gas Companies to Boost Spending in 2022

Oil and gas companies’ capital expenditures are expected to rebound significantly in 2022, driven by a favorable commodity price environment and record cash flow. Notably, spending remains well below 2019 pre-pandemic levels. Meanwhile, capital discipline remains key, with the industry reaffirming its commitment to reducing debt, increasing shareholder returns, and increasing share buybacks. US upstream capital spending is expected to increase 32% this year from a year earlier, with most of it going to land assets. This could also prove conservative, as the private E&P sector is likely to push spending even higher. [LINK]

Construction Equipment Rental Market Worth $105.29 Billion by 2030: Grand View Research, Inc.

The global construction equipment rental market size is expected to reach $105.29 billion by 2030, a CAGR of 4.2% during the forecast period. Rising government investment in the infrastructure sector and increasing Foreign Direct Investment (FDI) in the construction domain to develop roads, highways, expressways, bridges, skyscrapers, and smart cities have created a demand for rental construction equipment. Constant technological advancements to produce cutting-edge project-oriented construction equipment that optimizes the overall construction process is propelling the growth of the construction equipment rental market. [LINK]