Industrial and Construction Services Newsletter – Q3 2022

TKO Miller Market Analysis

Industrial and Construction Services

- After public markets optimistically priced in the possibility of a brief recession with soft landing potential, the third quarter for the broader economy came to a rather disappointing conclusion

- The fed doubled down on its hawkish rhetoric, moving to will companies into hiring freezes, reduced capital expenditures, and overall economic slowdown viewed as necessary to curb inflation

- While the broader economic outlook remains murky, industrial and construction services business leaders seem to be adjusting somewhat to cost pressures that created challenges over the past year and a half:

- Supply chain issues have begun to stabilize and freight prices are trending down nominally in the short term

- Many contractors have started taking defensive measures including building out larger-than-average backlogs and shoring up balance sheets in anticipation of potentially slower years to come (particularly on the commercial side)

- Personnel from labor to management talent remains in hot demand and short supply, and the job market in industrial and construction services feels as competitive as ever

- Despite persisting downward margin pressure, many indicators suggest healthy demand: Dodge’s Momentum Index remains near its highest level since 2008 and select government spending bills such as the Infrastructure Package and the CHIPS Act, are expected to underpin demand for years to come

M&A Conditions

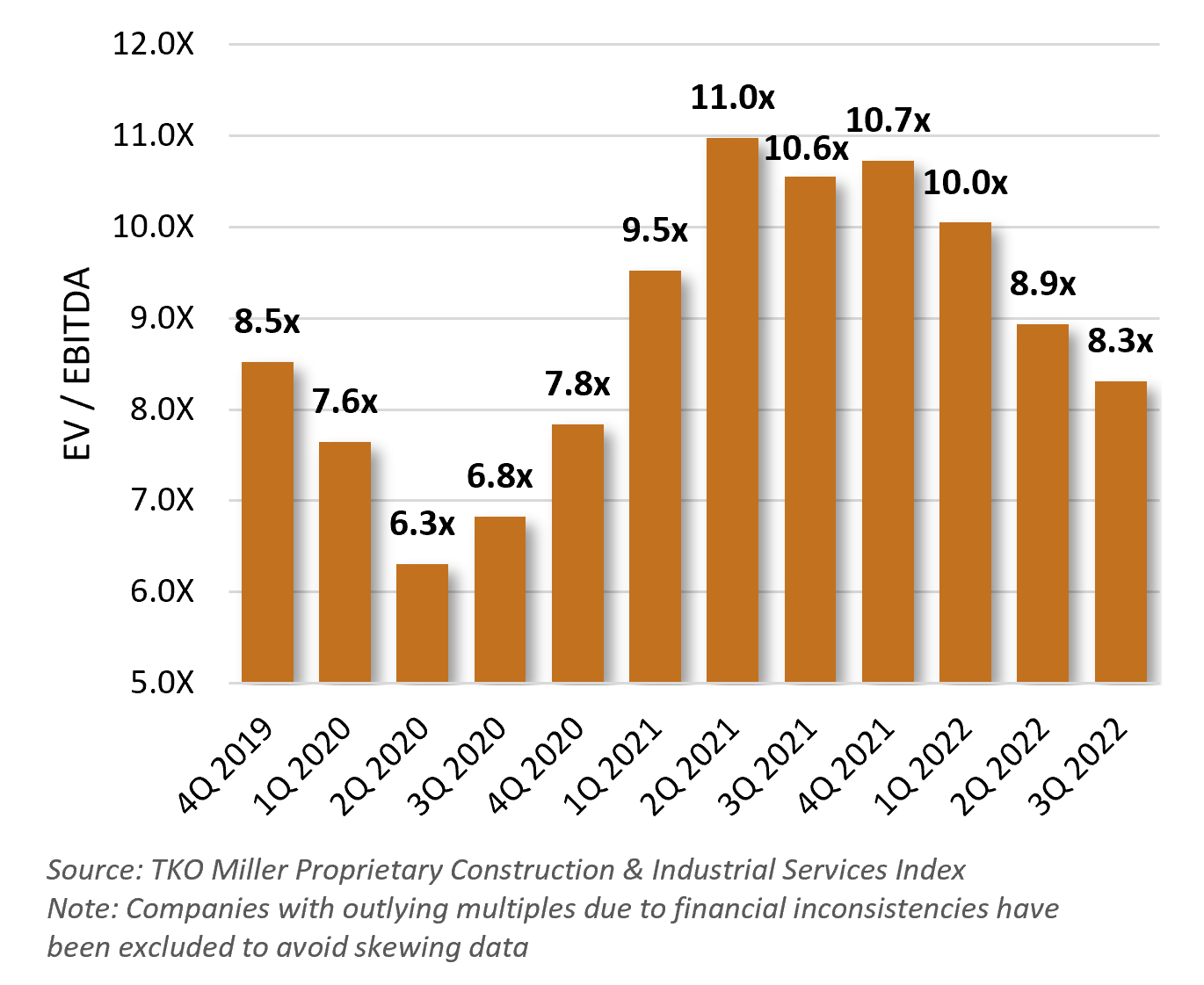

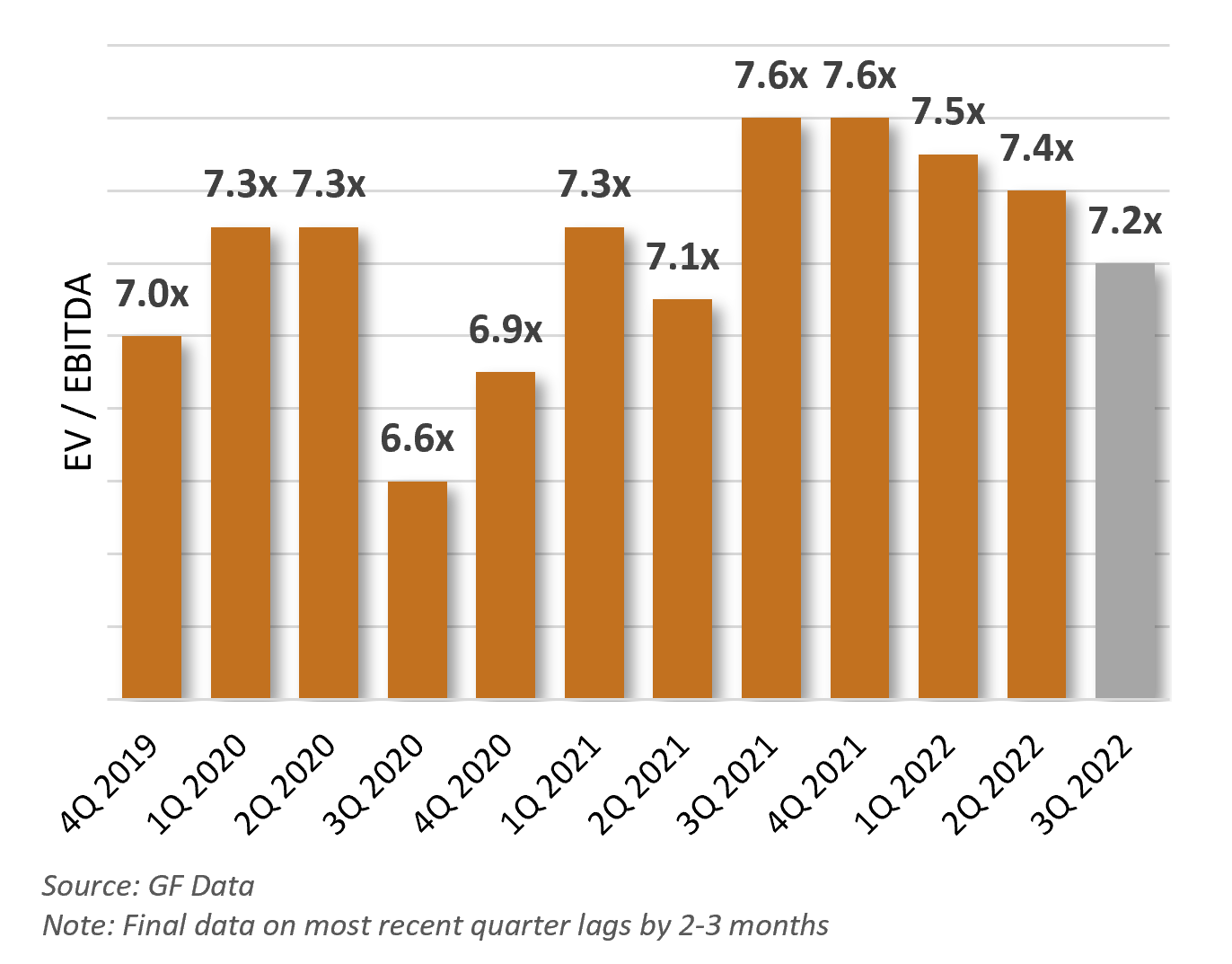

- M&A volume is down compared to 2021 highs as near-term uncertainty and tightening credit markets make it difficult for management teams to justify allocating capital to acquisitions; however, multiples are only just returning to pre-COVID levels

- Buyers have shifted their interest to more defensive, recession-resistant sectors such as industrial, municipal, and infrastructure maintenance, which is viewed as less cyclical

- This sector has seen increased attention from private equity buyers in particular as several large industrial service companies were acquired by private equity in Q3 2022, including H.I.G. Capital’s acquisition of Terra Millennium

- Commercial / residential construction, as well as the building products companies primarily supplying these industries, have fallen out of favor to some degree as these segments are viewed as highly cyclical

- We expect buyers to remain active in M&A even if general economic conditions weaken. As long liquidity remains strong, M&A will continue to be viewed as an efficient use of capital that offers better returns compared to other investment activity

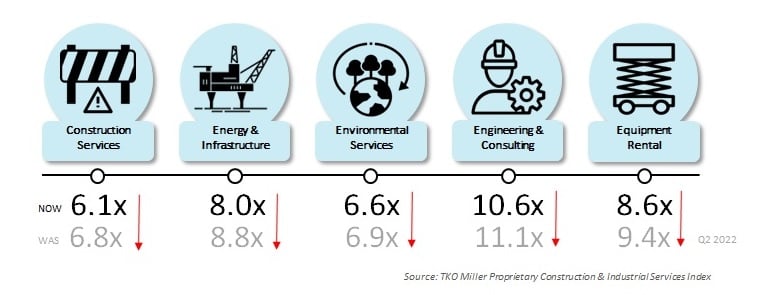

Where Are Industrial & Construction Subsectors Valued? (Q3 2022 EV / EBITDA)

Notable Industrial & Construction Services Transactions Q3 | 2022

Alimak, a world-leading provider of vertical access solutions, has entered into an agreement to acquire Tractel, a global provider of work at height products and safety systems, for $510 million in cash. This transformational acquisition underlines Alimak Group’s profitable growth strategy and ambition to expand their global market presence. The combined businesses will bring in total revenues of around $591.5 million.

H.I.G. Capital, a leading global alternative investment firm, has closed its previously announced acquisition of Terra Millennium, a leading provider of outsourced industrial maintenance services. The acquisition will allow Terra Millennium to continue executing their growth plans and vision for the Company, including deepening their presence in attractive geographies, expanding their service offering, and pursuing add-on acquisitions.

KLH Capital, a private equity firm serving lower middle-market companies in the specialty services, value-added distribution, and niche manufacturing industries, has completed a recapitalization of Thorpe Specialty Services, a leading specialty services provider of maintenance and engineering for corrosion, refractory, scaffolding, and insulation in energy and industrial markets. The primary goal of this recapitalization is to provide the resources for Thorpe to continue its growth trajectory.

Terex Materials Processing, a global leader in aggregate, environmental, concrete, lifting, and handling machinery, has acquired ProAll, a Canadian specialist producer of mobile volumetric concrete mixers. The acquisition will enable Terex to expand its presence in U.S. concrete markets and also sell to non-U.S. markets, adding a new dimension to the current portfolio and creating significant new opportunities internationally.

Altrad, an industrial services provider headquartered in France, has acquired Doosan Babcock Limited, a specialist in the delivery of engineering, aftermarket and upgrade services to the nuclear, thermal, oil and gas, petrochemical and process sectors. To reflect the new ownership structure, the business will now be renamed Altrad Babcock Limited, thereby preserving the rich heritage of the Babcock brand, which is synonymous with delivering engineering excellence for its clients across a broad international footprint.

Rental Equipment Investment Corp., a portfolio company of Kinderhook Industries LLC, has acquired Blackout Energy Services. Rental Equipment Investment Corp. is a multi-regional rental equipment services platform that offers a broad selection of general and specialty rental equipment. Blackout Energy is a provider of specialty rental equipment, specializing in flameless heaters and light towers. Blackout Energy represents REIC’s third add-on acquisition under Kinderhook’s ownership and the company’s 15th since its inception.

Industrial and Construction Services Valuation Index

Middle Market Valuation Multiples

Industrial and Construction Services News

Construction Input Costs Decrease 1.1 Percent Amid Falling Fuel Prices, But Other Goods and Some Services Continue Upward Price Trend

The price of materials and services used in nonresidential construction declined by 1.1 percent from July to August 2022 as a steep drop in fuel prices masked increases in the cost of other construction inputs, according to an analysis of government data by the Associated General Contractors of America. Association officials cautioned that limited price declines cannot undo the harm of clogged supply lines and labor shortages. Prices of several widely used goods, such as wallboard, construction machinery and equipment, flat glass, copper, ready-mixed concrete, and asphalt paving mixtures rose in August, partially offsetting declines for fuel, lumber, and some metal products prices. [LINK]

Armed With Steady Backlogs, Nonresidential Construction Pros Shrug Off Recession Fears

Nonresidential contractor confidence rose in August and backlog held steady as builders shook off fears of a looming recession, according to Associated Builders and Contractors, despite evidence that the Federal Reserve will need to escalate its war on inflation even more via continued rate increases. The ABC’s Construction Backlog Indicator, which measures the months of work contractors have won but haven’t yet started, held at 8.7 months in August, the same level as July and a full month higher than August 2021. The sustained level came amid increases in the commercial and institutional sector, as well as heavy industrial projects, even as the bookings for infrastructure projects fell. The results helped buoy contractors’ optimism for sales, staffing — and most tellingly, profit margins — over the next six months, all of which rose from July’s reading, though they were still below year-ago levels. Profit expectations have been hampered this year by continued inflation and higher staffing costs. [LINK]

Understanding American’s Labor Shortage

At the height of the pandemic, more than 120,000 businesses temporarily closed, and more than 30 million U.S. workers were unemployed. Since then, job openings have steadily increased since January 2020 while unemployment has slowly declined. Factors contributing to the labor shortage include early retirements, lack of access to childcare, and new business starts. Meanwhile, there has been a “Great Reshuffle” among workers. “The Great Resignation” worked its way in as the shift of labor force started to become apparent. A full 4.4 million people quit their jobs in May 2022, but hiring has outpaced quits since November 2020. Understanding why workers are missing from unfilled jobs is only half of the equation. The next step in addressing the labor shortage is to implement solutions to attract and retain new workers. [LINK]

Why Broader Market Inflation is Fueling Supply Chain Volatility

The interconnectedness of global supply chains directly correlates with market inflation. Increases in labor, energy, and transport costs are contributing to inflation around the world. With an increase in geopolitical tension, we have seen the return of inflation in most markets. Part of the bigger challenge as overall inflation rises is the cost of living, particularly in democracies. Governments often start to use the tools they have available, such as policies and restrictions, to temper the effects of inflation. A government becoming more directly involved in trying to sure up supply chain issues can lead to a lot of disruption itself, particularly when some of the corresponding policies are unpredictable or are mired in tight election cycles. [LINK]