Industrial and Construction Services Newsletter – Q4 2022

TKO Miller Market Analysis

Industrial and Construction Services

- 2022 was a year marred by inflation, tight capital markets, labor scarcity, and broken supply chains, persisting conditions which are unlikely to simply disappear in 2023 despite a hot start to the year in public markets

- However, in the face of these economic hardships, operators in the construction services market are optimistic about 2023, driven by a much clearer understanding of anticipated project costs and pricing than they were at the start of 2022

- Backlogs are strong across geographies on the commercial construction side as geographic hot spots such as Florida, Texas, Denver, and the Mid-Atlantic regions continue to thrive and defy predictions of an end to the building / restoration boom

- Furthermore, regions that experienced lulls over the past two years such as Chicago and NYC are picking up the building pace

- On the industrial side, many executives are forecasting a strong year in 2023 fueled by an uptick in project starts in Q4 (including the much anticipated $2.2bn Champlain Hudson Power Express Transmission in New York) as well as publicly announced capex spending increases as a result of deferred maintenance projects from large companies including Chevron and ExxonMobil

- As monetary policy becomes clearer and economic certainty is restored to some extent, industrial access and multi-craft contractors are getting more aggressive on pricing, reinstating margins to at or above historical levels after having been squeezed over the past several years

M&A Conditions

- Despite global M&A volume being markedly lower in 2022 compared to the highs of 2021, the buyer universe remains robust as they continue adjusting to the new and ever-increasing rate environment

- Construction and industrial service M&A has picked up in recent months as both strategic and financial buyers are eager to do deals

- Specifically, TKO Miller is seeing more active buyers seeking industrial and field service, multi-craft, and scaffolding acquisitions than there have been in arguably the past decade

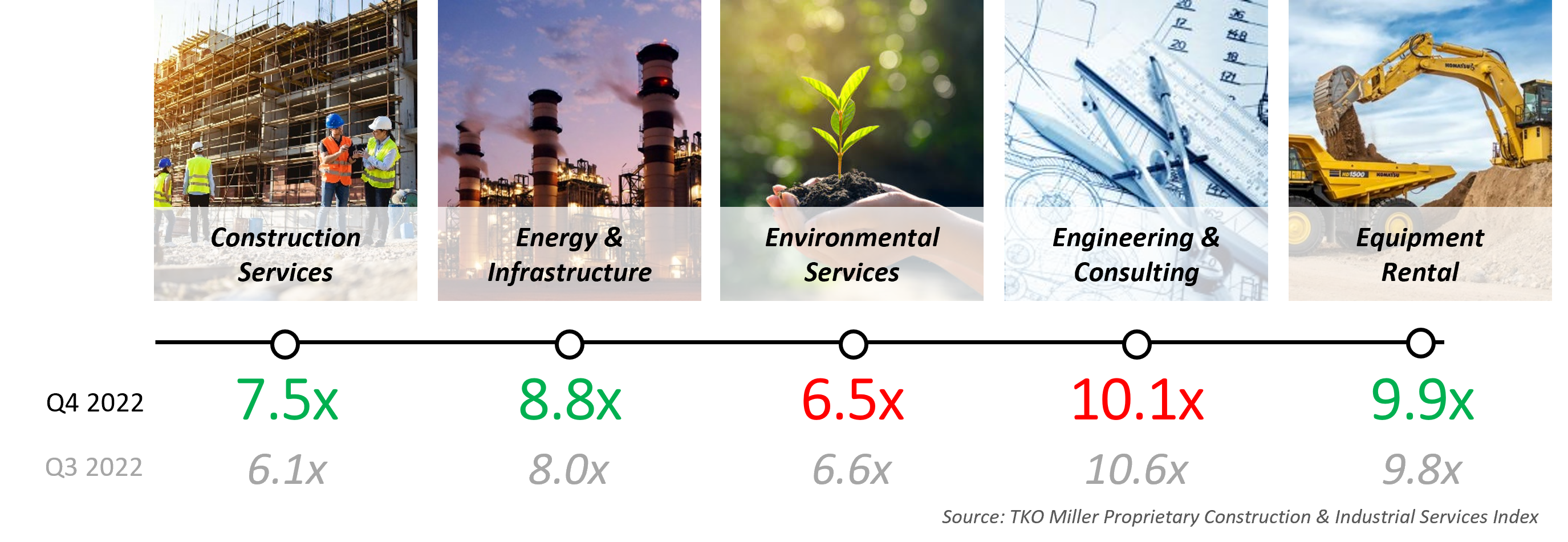

- Transaction multiples ticked up considerably for the Construction Services and Energy & Infrastructure sectors (see below)

- New buyers are also emerging on the commercial rental side, as mid-sized companies begin to explore acquisitions as an avenue for growth in the fragmented market

- Improving margins / overall financial profiles in the industrial service sector are making sellers more attractive while also providing the liquidity / stability to allow larger players to re-engage in acquisition searches

- TKO Miller expects 2023 to be an active year for construction and industrial services M&A

Where Are Industrial & Construction Subsectors Valued? (Q4 2022 EV / EBITDA)

Notable Industrial & Construction Services Transactions Q4 | 2022

American Industrial Partners’ (AIP) Brock Group, a provider of soft-craft services of scaffolding, insulation, paint and asbestos abatement to industrial, oil and gas, power generation, petrochemical and nuclear markets in the United States and Canada, has acquired Aegion Energy Services, a leading provider of critical services for energy infrastructure in maintenance, turnaround, construction and safety services markets along the West Coast, Montana and Utah.

Wynnchurch Capital, L.P., a leading middle market private equity firm, has acquired a majority ownership in Industrial Service Solutions from Edgewater Funds and JZ Capital. Industrial Service Solutions provides MRO-focused field, shop, and supply services for a diverse set of industrial markets. The Company’s regional shops are fully equipped to repair, overhaul, and inspect all process and rotating equipment types, brands, and applications.

Capstreet, a Houston-based lower middle-market private equity firm, has sold OnPoint Industrial Services, a specialized provider of safety, logistics and planning services designed to support complex maintenance projects in the refining and petrochemical industries, to MML Capital. Based in Deer Park, TX, OnPoint’s services include project planning and coordination, transportation and logistics, materials management, and safety services.

United Rentals, the largest equipment rental company in the world, has acquired Ahern Rentals, the largest independent family-owned equipment rental company in the world. The transaction adds approximately 2,100 employees, 60,000 rental assets and 106 locations to United Rentals in the United States and makes the company’s specialty rental solutions available to thousands of new construction and industrial customers. United Rentals acquired Ahern Rentals for approximately $2.0 billon in cash.

Sunbelt Rentals, an equipment rental provider for commercial, industrial, residential, and municipal industries has acquired Wagner Rental & Supply, a provider of equipment rentals, construction and safety supplies, and equipment sales and service for Southern Ohio and Northern Kentucky. Wagner Rental & Supply has been in business for nearly 75 years. The acquisition provides Wagner Rental & Supply with ways to better service the community and will help advance the careers of current employees. This is the 33rd transaction for Sunbelt Rentals since the beginning of Fiscal 2022.

AIP and the Brock Group have acquired Chinook Scaffolding Systems, LTD. Headquartered in Nanaimo, British Columbia, Canada, Chinook Scaffolding Systems is a leading provider of scaffolding and insulation systems serving oil and gas, smelters, mining, dams, and pulp and paper customers. Brock, acquired by AIP in 2017, noted that the acquisition adds market expansion into Western Canada and expands product and service offerings.

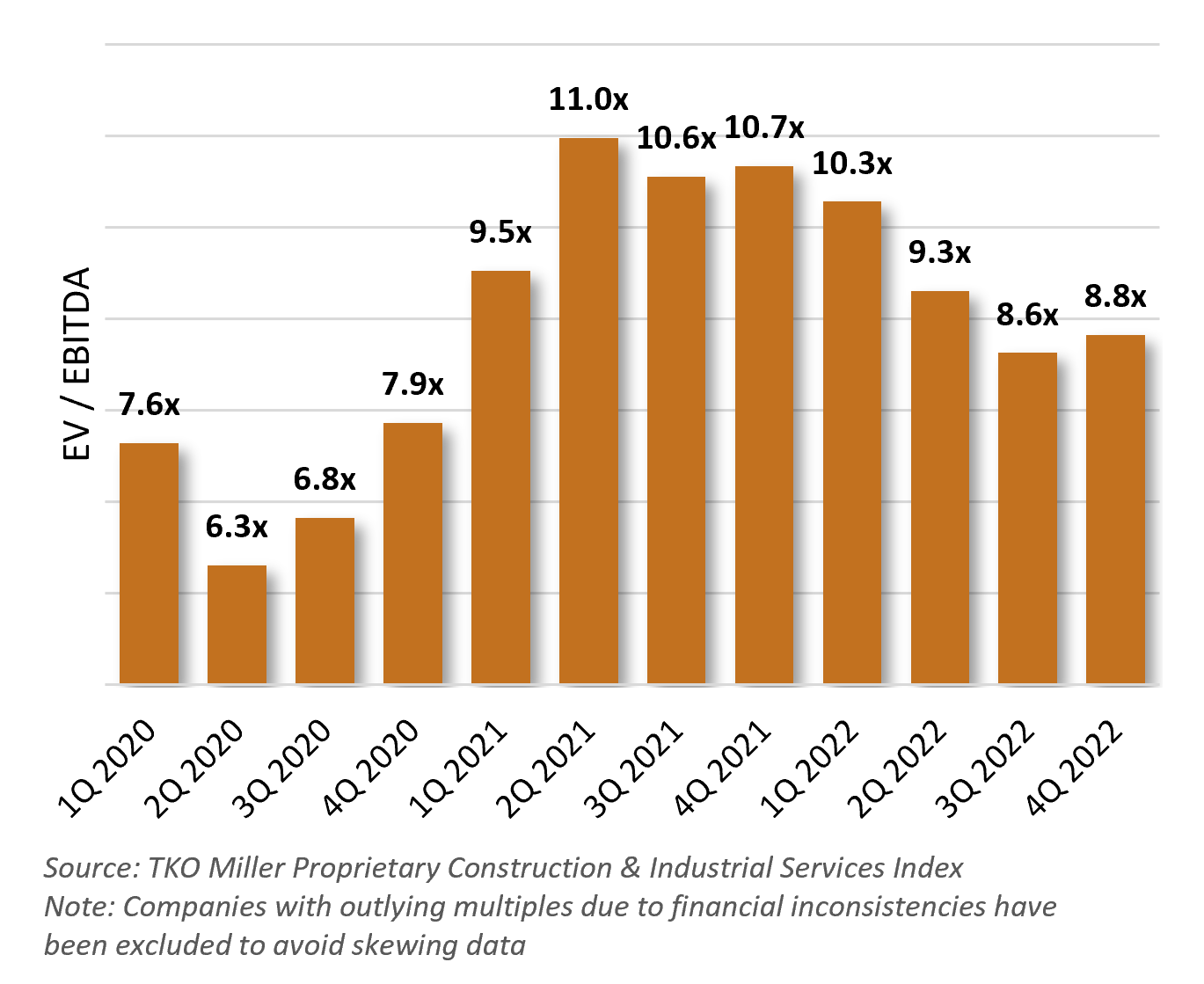

Industrial and Construction Services Valuation Index

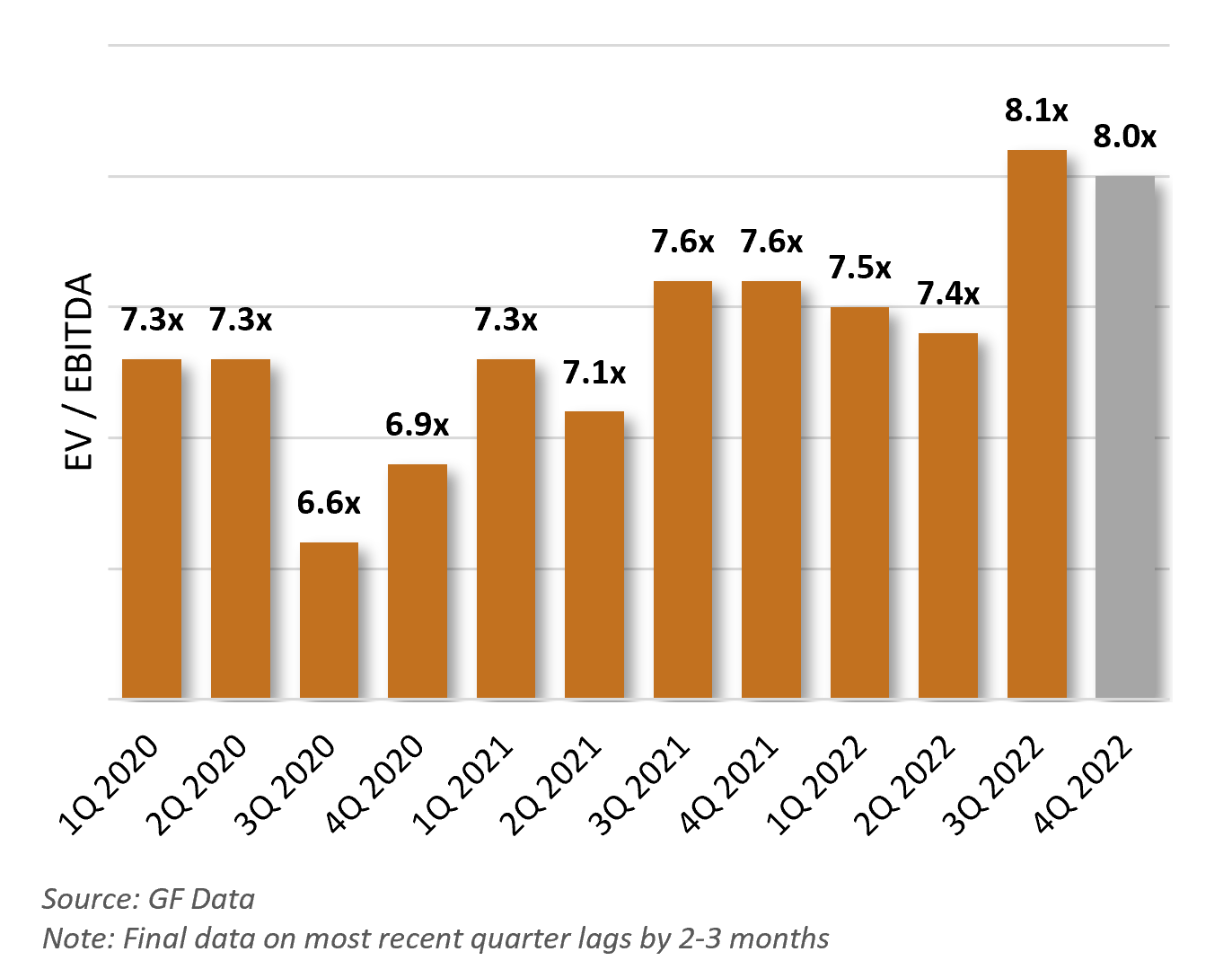

Middle Market Valuation Multiples

Industrial and Construction Services News

Which Way Will the Rental Industry Go in 2023?

There are many concerns on the horizon for the global industries, inflation being top of mind. This is not just a North American problem as Russia’s invasion of Ukraine sends ripples through global economies. The monetary policy response of higher interest rates are causing hesitancy among investors, which suppress capital-intensive activities such as construction projects. Issues in the rental industry are no different. Supply chain difficulties impacting equipment, chips, and other resources as well as an ongoing labor shortage are continuing concerns. Despite these headwinds, the rental industry does not seem worried and is optimistic for 2023. Demand is high, rental customers are busy, backlogs are strong, and federally funded infrastructure projects continue to progress. For the most part, a continuing cycle of growth is expected in 2023, but the rate of growth is expected to slow down. [LINK]

Equipment Manufacturers Feel Supply Chain Crunch, Worker Shortages

A new survey of more than 150 equipment manufacturing companies released today by the Association of Equipment Manufacturers (AEM) warns that U.S. equipment manufacturers continue to face supply chain issues and a persistent labor shortage nearly three years after the onset of the pandemic. AEM surveyed 179 equipment manufacturing executives on the causes of supply chain disruptions and bottlenecks, and the impact it has on production, lead times, and profit margins. Nearly all respondents (98 percent) still face supply chain issues, with more than half of respondents (58 percent) experiencing continuously worsening supply chain conditions. The two driving factors of current supply chain disruptions are workforce shortages and access to intermediate components for production. [LINK]

Strong Construction Backlogs Report Includes Warning of Tighter Financing

ABC’s Construction Backlog Indicator reached its highest level in November since the second quarter of 2019, as contractors with under $30 million in revenue landed new jobs faster than expected. That high water mark was matched again in December. The strong backlog reading indicates the construction industry continues to fend off any recessionary concerns. That means for now, construction pros are emphasizing the positive. But while the report suggests optimism in 2023, contractors’ outlook could soon turn more pessimistic. Financing commercial real estate projects has become more challenging, largely due to higher rates and recession predictions. [LINK]

‘Good News is Bad News’ in the Latest Labor Report

Construction’s job openings were largely flat in November compared to the month before, according to new Bureau of Labor Statistics data. The number of unfilled positions for which contractors are actively recruiting declined by 2,000 to 388,000, according to analysis from Associated Builders and Contractors. Despite rising interest rates during the last 10 months, the Federal Reserve is still grappling with an excessively tight labor market associated with rapid compensation cost increases. In order for the Federal Reserve to reel in inflation, it needs a labor market with fewer open jobs, more unemployment and slower compensation growth. As interest rates continue to rise, they will impact financing costs—including wages—and potentially set up declines in private construction activity. [LINK]