The “Inven-story”: Managing Inventory Before You Sell Your Business

When you first visit with a manufacturing company to talk about selling their business, it can be difficult to discern their inventory management philosophy. It can be even more difficult when speaking with a business owner who may not have been paying close attention to the inventory buying habits of the operations manager. As difficult as it can be to get to the bottom of this, it is an important line of questioning. The fact of the matter is, if you carry too much inventory, you are going to lose money when you sell your business.

Middle market businesses generally sell for multiples of EBITDA (based on growth prospects and other industry-specific factors). There can be a disconnect between a poorly managed balance sheet and a company’s income statement. Not paying attention to inventory can be problematic, as it is generally one of the largest asset categories and ties up a tremendous amount of capital.

Here’s how it typically develops. A growing company gets a line of credit from their bank. They use that line of credit to buy inventory. Operations managers realize very quickly that carrying a lot of inventory can make running a plant much easier. With abundant inventory you have rapid turnaround times, can provide customers with close to just-in-time delivery, and you have greater flexibility when planning production runs.

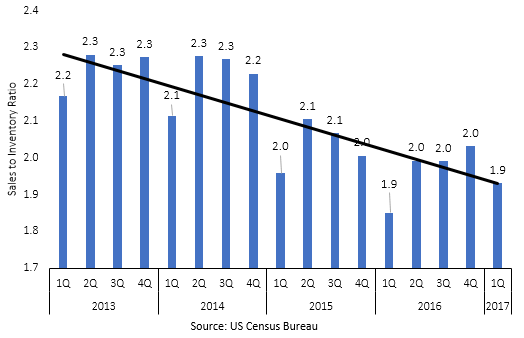

According to the US Census Bureau’s Manufacturing and Trade Survey data, businesses continue to add inventory without a corresponding increase in sales. Average sales/inventory for manufacturing companies was at 1.9 in the first quarter of 2017, continuing several quarters of declining inventory performance.

Why is This Happening?

There can be a number of reasons why business owners aren’t being as careful around inventory spend.

1) They need to do a better job around integrated business projecting and management of resources. Business planning that matches sales projections to inventory levels requires a deep understanding of your business, your supplier’s business, and your customer’s demands. Proper inventory control requires excellent forecasting around sales and customer service.

2) They don’t have the technology or data available to understand inventory consumption and planning.

But most often the answer is,

3) They don’t have the management discipline to keep inventory levels in check. Companies have been presented with an unprecedented level of low-cost capital and many business owners are using this to stockpile inventory.

Keeping elevated levels of inventory can seem perplexing but in the face of uncertain customer demand, supplier lead times, and projected economic growth, it can make operating a manufacturing business much easier.

How Keeping Too Much Inventory Costs You Money When You Sell Your Business

Remember, buyers are generally paying a multiple of earnings or EBITDA for a business. They will not pay extra if you happen to have a lot of inventory lying around. While it is possible to make an adjustment to the purchase price with a normalized working capital calculation, this won’t work if you have been keeping excess inventory around for many years. Generally, a working capital adjustment takes into account one year and adjusts for any balance sheet anomalies during that time period.

If you have been squirreling away inventory for longer than that, your ability to negotiate higher value for that surplus inventory goes right out the window.

How Do I Prevent Losing Money During a Sale?

In order to make sure you aren’t leaving money in the form of excess inventory on the table, you need to begin a program of efficiently managing your inventory well before you take your company to market. Ideally, an inventory management program would happen one to two years before you begin the process of selling your company.

Your investment banker can argue on your behalf that you have habitually kept too much inventory in the business and try to recoup some of that expense in additional purchase price, but it is a difficult argument to make. One, because if a buyer suddenly shifts course and manages inventory more efficiently, they don’t know how customers will react. Secondly, it is hard to convince a buyer that the business should be run with a different level of inventory than you, the seller, have been using. Inevitably, the “if that’s the case why haven’t you done it” argument will come into play.

If push comes to shove and you are selling right now and need to deal with inventory, look at what you’ve got very closely. If some of the inventory is obsolete or not salable, a buyer would not accept it so it’s best to just get rid of it in the most efficient way possible. The rest, which is presumably good inventory but superfluous to daily operation, can be reduced over time through normal business sales or returns to vendors. Working the inventory down over the life of the transaction, which takes about 7 to 9 months to complete, can go a long way toward reducing the working capital peg.

We see companies all the time with large lines of credit and minimal covenants from the bank. It may seem like a good use of capital to increase inventory to account for customer orders and supplier uncertainty. However, if you are contemplating a business sale in the next one to two years, it can be very costly to keep excess inventory.